When I think of Amazon, I think of two things. First, a huge, unexplored rainforest where movies like the classic Anaconda were filmed. I didn’t even know Jennifer Lopez was in that film. She looks different in that movie. It’s a pretty solid movie regardless. I am actually a huge snake fan. I considered becoming a herpetologist once and Steve Irwin used to be my idol. I was a wild pre-teen!

STOCK IN DISTRIBUTION PHASE

The second thing that comes to mind is a high priced stock of an incredible company that has great shipping and customer service. It’s also quite easy to trade, at least in my opinion.

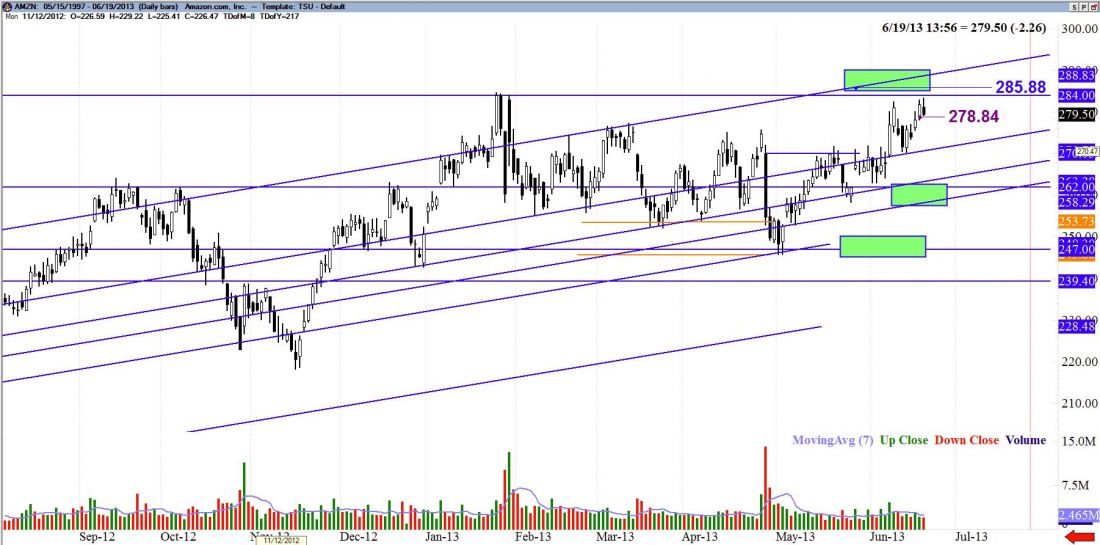

AMZN has been stuck in a pretty much sideways move (a distribution phase) since an earnings announcement back in mid January. The $284.00 level has been a ‘Stone Wall Jackson’ of a resistance for the last six months. It’s been a great location to sell covered calls, or implement the bear call spread. That’s what the green boxes on my charts represent. Bear call spread and bull put spreads. The combination of both creates an iron condor.

EYE ON UNFILLED GAP

AMZN has a small gap that is still un-filled, around $262.00. That is a nice bullish continuation sign. If AMZN closes above $285.88 the bulls could really take control of this stock once again.

JULY EARNINGS ANNOUNCEMENT

Earnings are due to report for AMZN around July 25th. This likely will be a longer term trade so ensure you buy enough time on your options and perhaps enter into a debit spread during earnings and possibly some protective puts to hedge against a free fall.

KEY LEVELS

Based on some Fibonacci projections, the first two targets would be $306 then $313 respectively.

Shop smart with AMZN – Enjoy!