On Wednesday the chairman of the Federal Reserve said out loud what everyone is thinking; that the Fed’s Quantitative Easing program is going to be scaled back, later this year or early next. Since everyone also thinks that it is only the Fed’s massive intervention that keeps the market from falling like a stone, the result has been a wicked couple of days in the S&P mini futures market.

THE CARNAGE

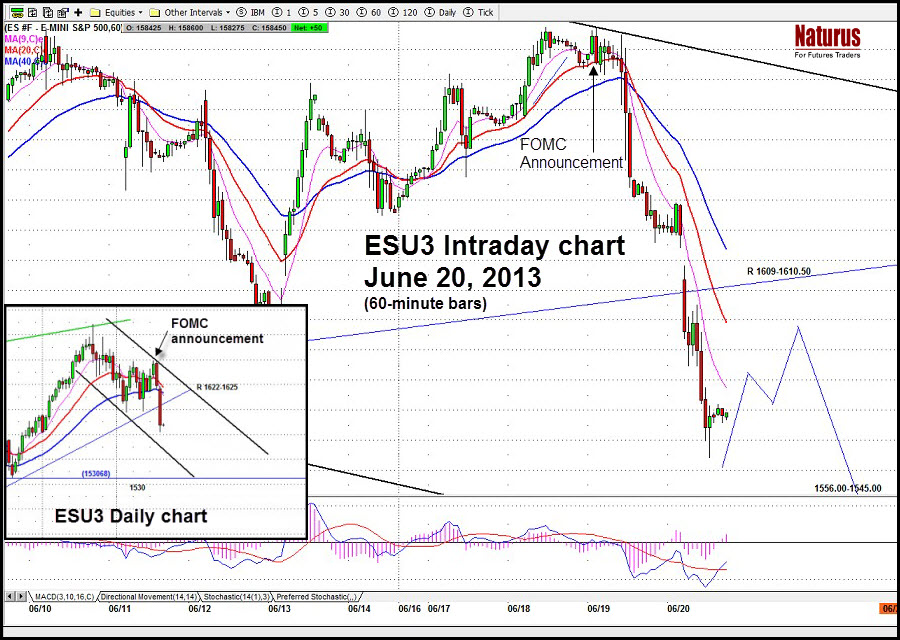

The futures have just suffered the worst two-day decline in 19 months; in New York stocks going down outnumbered stocks going up by a ratio of 5:1; the volume was unusually heavy to the downside; and the losses occurred despite $3 billion in purchases from the Federal Reserve’s Permanent Open Market Operation.

In addition, some important technical levels have been broken, including the 50-day moving average, and the short term uptrend support line.

“Wherever we look today there is carnage,” said Zero Hedge, the leading proponent of the case for a massive market sell-off and the voice of the market skeptics.

They may be right. On the daily chart (inset) the S&P mini futures (ESU3) have lost almost 115 points – at $50 per point per contract, when a million contracts or more a day are traded in the futures markets.

Chart:

S&P500 mini futures (ESU3)

But the intraday chart is the really scary part: the futures lost more than half of that – 80 points – in just two days. The chart looks like the architect’s drawings for the water slide at Disneyland. But much more dangerous.

So is this really the start of the Great Unwinding of the market, the cataclysmic free-fall that so many doom-sayers have been predicting?

Probably not yet. We think the May high at 1685.75 is probably the top for the futures for the summer. And we think that a likely target for this pullback is in the 1530-1545 range. But we aren’t going to get there today.

The futures have not declined for three days in a row since the start of the year. Today is option expiration, and the bulls will be working hard to keep the market at a level that lets the options they sold expire worthless. And the market is massively over-sold, which means we are due for a little oversold bounce, if for no other reason than to allow the shorts to cash out..

So today we will be looking for a little bounce, to reclaim the 1600 level and maybe return to the recent high around 1607-1609. However our fundamental short-term stance is now bearish. We are looking for a decent entry to go short.

But regardless of today’s (Friday’s) price action, by the time the afternoon winds down, we will go home flat. This is not the weekend to be holding open futures positions – on either side of the market.

= = =

Naturus is the web name of Polly Dampier, the brains behind Naturus.com, where she gives active traders real-time guidance on futures markets. Visit www.naturus.com to learn more.