“The only thing to do when a man is wrong is to be right by ceasing to be wrong.” —Jesse Livermore

That sounds to me an awful lot like: “go with the flow, or follow the trend, or don’t fight the market.”

And it’s a good thing we’ve been discussing how to enter a trend with the trend for the past few weeks. Otherwise we might have found ourselves on the wrong side of things after Mr. Ben shocked the financial world by letting us all know that eventually, at some indeterminate time sometime in the future, the markets maybe just might have to get by all on their own without the aid of an 86 billion dollar monthly steroid injection. But not yet…

I know, I was caught off guard as much as you were.

EURO ACTION LAST WEEK

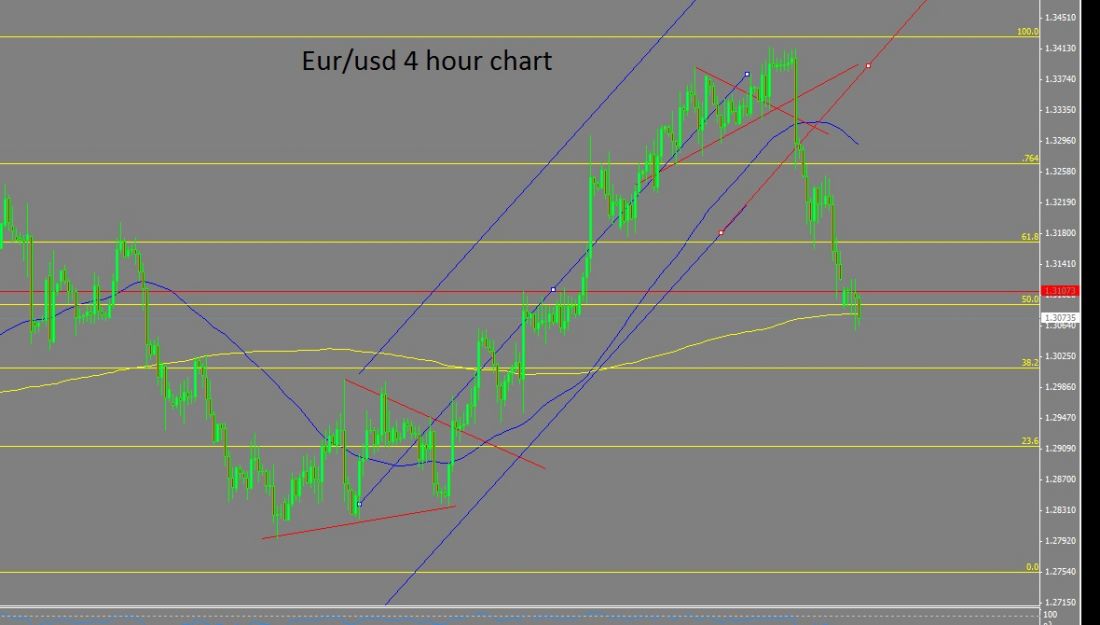

To reiterate, I’ve been discussing buying into consolidation patterns instead of trying to sell tops. Let’s look at last week. We saw one final rather unconvincing push higher in the euro when we broke a nice triangle and from there things stalled. Remember, that’s our first warning sign. Look at levels to offer potential support and resistance.

LISTEN TO THE CHARTS

Obviously, you can range trade some in a consolidation, but we’re talking about trend trading here. And, just as obviously, we had no reason to think our euro uptrend wouldn’t remain intact until the charts gave us reason to think otherwise.

WHAT’S NEXT?

Next step is to continue adjusting our regression trend channel as price closes above the center line. On the attached four-hour chart, last time we did this was mid-way through June 16. The sell-off on June 19, gave us the first solid indication of a trend change. Price had stopped on a prior level, and a bearish candle like that is rather convincing. But, it also stopped on a prior level, and trendline. So, one could buy here for a bounce. One would have lost money, but hey, that happens.

Next, price breaks the channel and the prudent thing to do is wait for a breather and jump in. That’s what I did anyway. The first option to buy for a bounce, or sell for a continued move short came right on the .382 retracement of the prior daily swing move higher (Never saw that coming did you – I love how this technical stuff works).

KEY LEVELS TO WATCH NOW

Right now we’re sitting on the 50 day (200 4 hour moving average more or less, on this chart) and a nice strong 50% retracement.

You have three things you can do, sit here, or buy on his level for a potential bounce that might not happen, or sell a bounce that might not happen or just get in one direction or the other.

Yeah, ok, that was four things, but you don’t really count sitting here doing nothing as doing something in trading do you? (You probably should by the way.)

As long as you define your risk and have a money management plan in place, all of those are decent trading options at this level. Next week, I’ll let you know how my choice turned out.