Most of the focus lately has been on the weakness in U.S. and Asian equity markets. Rightfully so, I suppose. However, these are not the only markets under pressure.

Our neighbors to the north, sometimes called America’s hat, are actually underperforming our stock market here in the U.S.

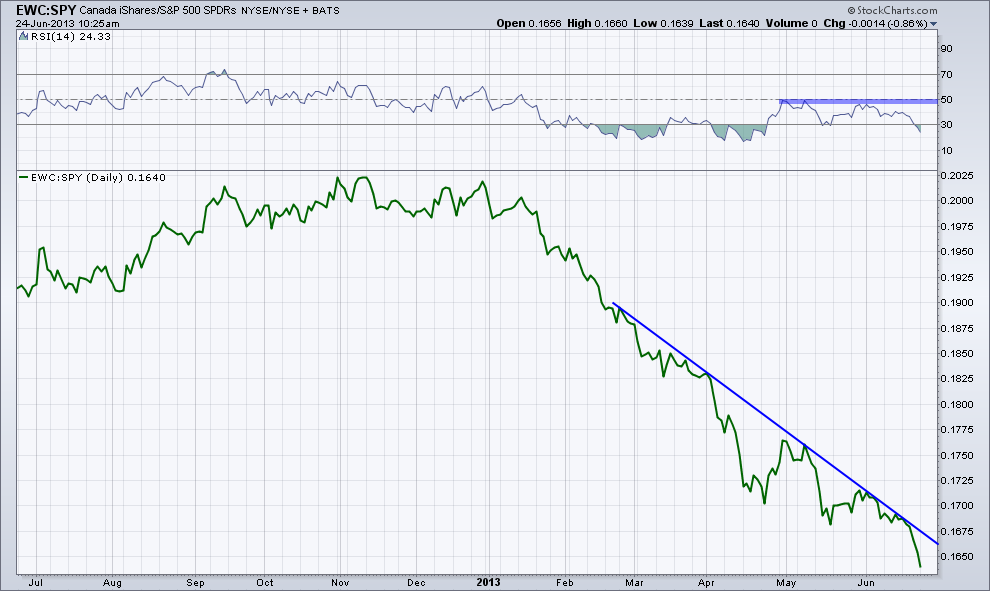

The chart below shows the relationship between iShares Canada ($EWC) and S&P 500 SPDR ($SPY). When the green line is falling it means Canadian equities are falling more or rising less than U.S. stocks. Looking back at the last four months of 2012 we can see some deterioration in strength coming out of Canada. The Relative Strength Index was able to break above 70 as price appreciated off the August low. But momentum was unable to stay elevated and began to diverge from the relationship between EWC and SPY. This was a clue that something may be getting ready to shift in relative performance between the two neighboring countries.

Turning our focus to more recent price action, we can see that the RSI indicator has been staying depressed during a large chunk of 2013 and has been unable to get above 50 as bears keep EWC underperforming SPY. Canadian bulls will be looking for the green line on the chart to break above the falling blue trend line and to get momentum back on their side with a shift above resistance of 45-50.

Disclaimer: The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.