In the coming year Swift Transportation (SWFT) is looking to grow and make strides through their success within the intermodal business. The company is the largest truckload provider within the U.S but plans to expand the number of tractors and trailers that it owns.

Swift also hopes to reduce its debt balance and lower their expense interest rates. Among other transportation companies, Swift is one that will be a top competitor due to expected growth and profits from within its truckload segment.

THE NUMBERS

The company is expecting a 2% to 3% increase in truckload pricing which would allow them to have 10% to 15% net gains this year. Analysts at TheStreet have recently upgraded the stock to a buy and give the company praise on their solid cash flow from operations and their earnings per share growth.

From the companies last quarterly earnings they announced $856.8 million in revenue, which was below expectations. Although the company is showing low profit margins, its positives from growth in net income are expected to help the company succeed as they move forward.

LOOKING AHEAD

Within the next few years the completion of the $5.2 billion expansion of the Panama Canal is expected to be finished. This project will allow for a 160% increase in the size of ships that will be able to pass through the canal. The expansion of the Panama Canal could mean big gains for a company like Swift Transportation, which would allow them to increase the amount of shipments that they would be able to send to ports throughout the southeastern part of the U.S.

UNUSUAL OPTION ACTIVITY:

We define unusual option activity as large block trades that represent a large percentage of daily option volume. The block trade is considered “unusual” if the option volume is above the average daily volume over the past 22 days. At KeeneOnTheMarket.com we scan and analyze order flow from all of the major options exchanges in order to identify any unusual option activity.

Analyzing unusual order flow gives traders a window into what the positions that large institutional players have. The majority of unusual option activity can be traced back to hedge funds, mutual funds, and other large institutions. Knowing where these institutions are placing their bets can be hugely advantageous for any trader. These institutions have informational and technological advantages that the average trader doesn’t have, and the amount of time and analysis that goes into every one of their trades is substantial.

Order flow can however at times be deceiving. One might logically thing that a large block buyer of calls is bullish on the underlying. This is not always the case. Remember that a large number of participants in the equity options market are hedgers. Long calls are a hedge against short stock, and long puts are a hedge against long stock. With this in mind we have developed a 7 step trading plan that helps filter out unusual option activity that will not provide actionable trade setups. It is by using this plan that we are able to identify the most significant unusual options activity trades every day.

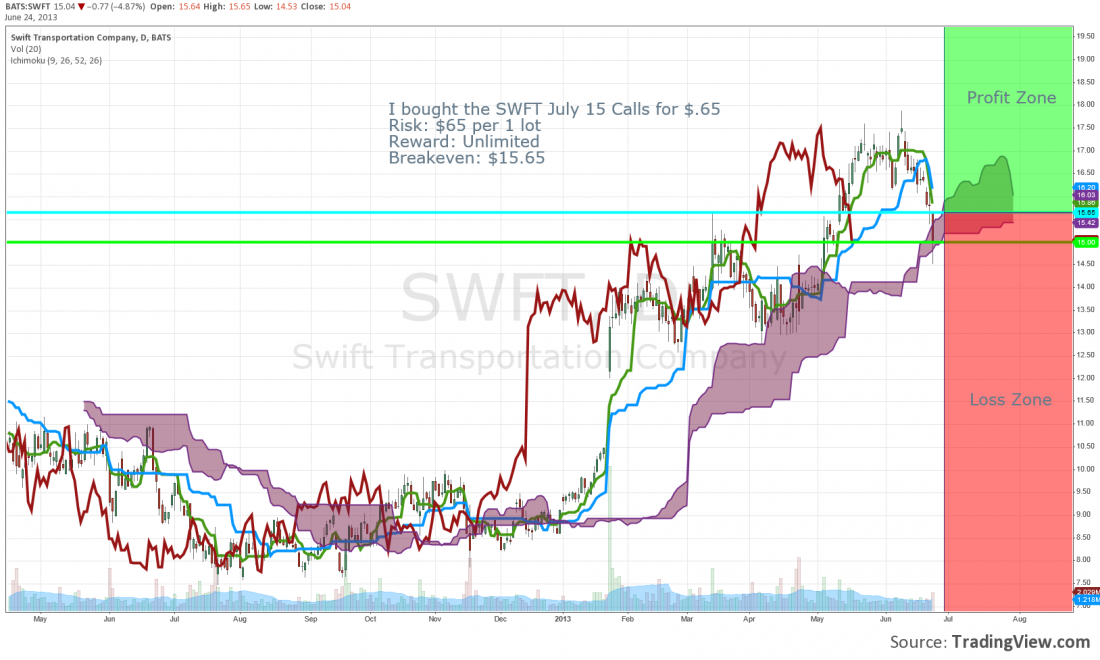

The “Institutional Trade”: A trader bought 1260 SWFT July 15 Calls for $.65

Risk: $65 per 1 lot

Reward: Unlimited

Breakeven: $15.65

Cash Outlay: $81,900

MY TRADE

I bought the 1260 SWFT July 15 Calls for $.65

Risk: $65 per 1 lot

Reward: Unlimited

Breakeven: $15.65

GREEKS OF THIS TRADE

Delta: Long

Gamma: Long

Theta: Short

Vega: Long