The last several months have turned the income investing world upside down as soaring interest rates have negatively affected nearly every dividend yielding asset class. Consider that the 10-Year Treasury Note Yield has risen to a new two-year high of 2.7% from a low of 1.6% just since early May. This vertical ascent has been driven by fears of asset purchase tapering from the Federal Reserve which has thrown a wrench in fixed-income, real estate investment trusts, preferred stocks, and even dividend paying equities.

Prior to this jolt, income investors had been accustomed to low volatility and excellent risk-adjusted returns that were driven by loose monetary policies.

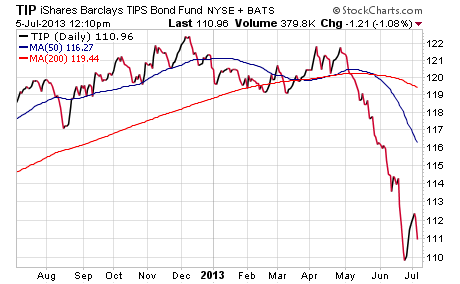

However, the new interest rate environment has everyone scrambling to adjust their asset allocation to insulate their portfolio from additional downside. TrimTabs reported an estimated $80 billion was yanked from bond ETFs and mutual funds in the month of June alone. This has led to risk aversion, especially in underperforming fixed-income sectors such as the iShares TIPS Bond Fund (TIP) and the iShares Investment Grade Corporate Bond Fund (LQD).

Not surprisingly, some of the areas of the bond market that have held up the best over the last several months have been funds with lower average durations and less sensitivity to interest rates. The PowerShares Senior Loan Portfolio (BKLN) and the Vanguard Short Term Bond Fund (BSV) are just modestly off their highs and according to Index Universe have continued to see strong fund flows in 2013. Floating rate notes in particular have received a great deal of attention this year because of their ability to adjust their coupon rate on a quarterly basis to mitigate interest rate risk.

Turning now to the dividend paying equity and high yield spectrum we have seen a great deal of volatility come back into income ETF favorites such as the iShares High Yield Bond ETF (HYG), iShares U.S. Preferred Stock ETF (PFF), and the iShares Mortgage Real Estate Capped ETF (REM). Mortgage REITs in particular have been ravaged by swiftly rising interest rates because of their direct affiliation with the mortgage and credit markets which have undergone a complete transformation in the last 90 days.

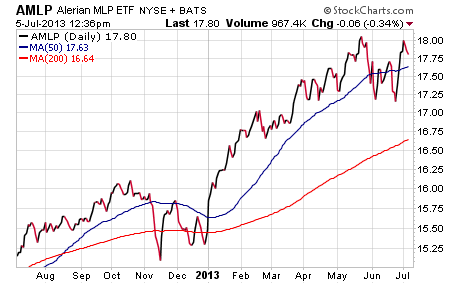

It seems that the best area of high yield to hide out in this year has been master limited partnerships. The Alerian MLP ETF (AMLP) is very close to its 2013 highs and has continued to outperform most income generating asset classes. MLPs normally come under fire during times of volatility in the stock market but this sector has held up mostly because of the relative strength in crude oil which just recently surpassed $100 per barrel this year.

Other more traditional dividend paying equity funds such as the iShares Select Dividend ETF (DVY) and iShares High Dividend ETF (HDV) have also shown some recent relative strength due in part to positive economic reports which have helped stabilize stock prices.

One thing I think we can all agree on is that the next six months will most likely not look anything like the last six months. My own personal conviction is that we will see a return of stability in interest rates which may reverse the trend of bond fund redemptions. In addition, I would not be surprised to see a more profound correction in stocks during the next six months. While the timing and depth of the correction are unknown, the key will be navigating this volatility with an eye towards risk management and the ability to take advantage of new opportunities with dry powder.

Disclosure: The author currently has a position in DVY and HYG in his personal account.