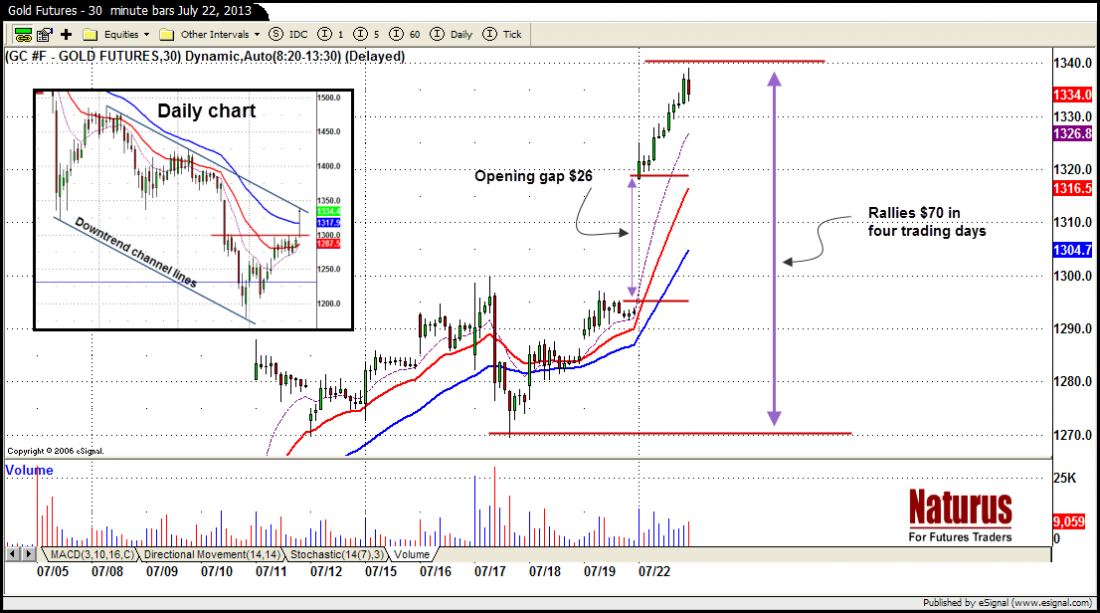

Gold futures made a decisive breakout move on Monday. After trying – and failing– to break through resistance around $1300 for the past two weeks, the current contract gapped up $26 at the opening Monday, and marched resolutely up all day long to close in the top half of the trading range.

The futures have now gained almost $70 in four trading days – a pretty good rally any time, but especially welcome after the beat-down gold has suffered this year.

Gold futures – July 22, 2013 (30-minute bars)

For the longer-term, we are still bearish on gold, and a glance at the daily chart (insert) shows why. Monday’s rally stopped at the upper boundary of the downtrend channel, but the downtrend remains intact.

Nevertheless this rally offers good opportunities for low-risk swing trades. Here’s how to manage them:

WHAT TO DO NEXT

We trade the gold futures, and we have been calling short term scalping long positions for our subscribers for about a week. Now we are reluctant to enter new long positions at this level, because we still believe gold has a chance for a substantial decline.

The market has moved above the major resistance area around $1328.50, and closed above the daily moving averages, but stalled at an important level, the downtrend channel line. And we do not yet have a clear buying signal.

So we want to see a decent retracement to get in on the long side at a better price.

• For aggressive traders, use a pullback to today’s opening break-out point around $1300

• For conservative traders – and those who are more risk-adverse – enter on a retracement to the lower resistance level $1280-65

• But if the futures contract falls below $1256, get out of any long positions; the market could move back down to form a double bottom.

Remember, these are short-term swing trades; don’t fall in love with your position and use protective stops.

All of these entry levels will attract new buyers, and the pull-back can stall and move back up quickly, so stay alert. But don’t chase a market that is moving away from you.

It is frustrating to get the direction right but miss the trade because it didn’t reach your price. But it is much much better to be out of the market and wish you were in, than to be in a trade and wish you were out.

There’s always going to be another trade. Wait for it.

Polly Dampier – Naturus to her many online followers – is the brains behind Naturus.com, a paid subscription service for active futures traders. Each week she publishes a preview of the gold market. To get a free subscription follow this link