So far public support for U.S. military intervention in Syria is negligible —less than 10%, according to a recent Reuters/Ipsos poll. Perhaps because many Americans think they have seen this movie before, in Iraq and Afghanistan, and they don’t like how it comes out.

Nevertheless, after the statement yesterday by Secretary of State John Kerry and saber-rattling by unnamed officials, the likelihood of some sort of military action seems high. What effect will it have on the markets for gold and equities?

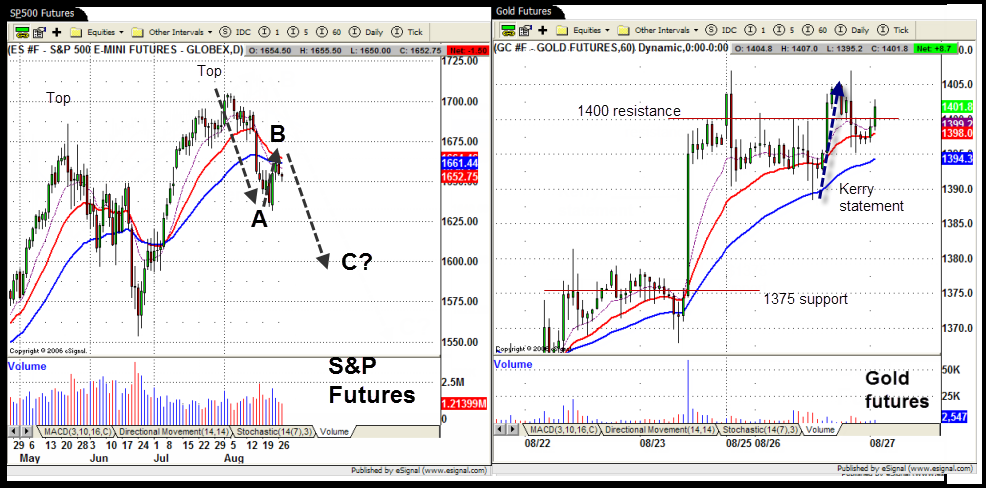

Judging by the initial reaction stocks go down and gold goes up.

In the hour after the statement was released, the S&P 500 futures dropped 10 points and closed near the low for the day. Gold spiked up almost $17 and broke through the resistance at $1,400 that has been holding it down for the past two days.

WHAT HAPPENS NEXT?

That was the initial reaction. What happens next?

We are expecting more of the same, not because we think war is good for markets, but because technical patterns developing in both those markets. War talk will drive the markets this week, but the technicals are likely to set the direction.

THE EQUITY MARKET

First stocks. The S&P 500 is forming a large “M” pattern with the high around 1705-06, followed by a decline and a small bounce. Yesterday (Monday) the bounce reached 1667.50 (in the futures) and we think that will be the high for that move. (See left chart)

The subsequent moves are most likely to form an A-B-C correction, where the first decline to the recent low about 1631.50 is the A move, the bounce to yesterday’s high (1667.50) is the B move, and the C move will be a decline below the previous low.

How big will the C decline be? We’re not sure. If the movement is symmetrical, it may match the A move, which would mean a drop of about 70 points, or somewhere south of 1600.00.

But these movements are often not symmetrical, so we are not calling that as a target. But we are pretty sure the decline will go below 1630.00.

GOLD

The gold market is a little trickier. There are frequent attempts to manipulate the gold market – even more than the equity markets, which are themselves regular targets of manipulation – and there has been a determined effort over the past couple of trading sessions to keep gold futures below $1,400 an ounce. (See right chart).

Every time gold approaches that level selling has come in to slam the price down. But yesterday gold broke that level, and overnight sellers were unable to push it back down. We could see the price reach our predicted target 1425-1450.

There may be some slowdown in the current bounce around 1425-1450 range as early longs cash in some of their profits.

But gold futures are in wave 3 of its correction wave. Sometimes wave 3 will last long time and move further than we expected. So long as the price holds above the 1375 level there may later be an extended up move.

War talk won’t change that. Just the opposite—when the cannons roar, so does gold.

= = =

Polly Dampier is the brains behind Naturus.com, a subscription service for active futures traders. For more information, or to subscribe to her free weekly market analysis, visit http://www.naturus.com.