Gold has been an interesting market to watch over the last twelve months.

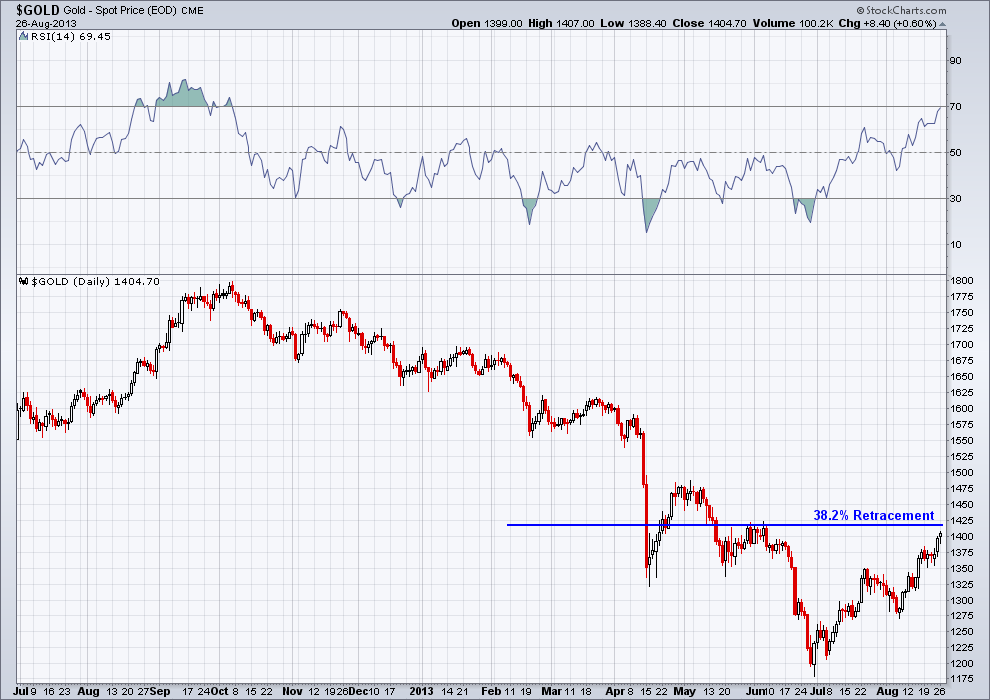

Seeing it fall from grace as it tested $1800/oz. last October and began to take the elevator down as sellers kicked it up a notch in April and June with massive sell offs. We could see the severity of the decline as the Relative Strength Index kept making lower lows with each bout of selling. We first broke the 30 ‘oversold’ level in December of last year, but with each break of support selling intensified as the RSI made lower lows. However we can see looking back in June that the pattern of RSI weakening alongside price diverged. This was the first clue that something might be shifting in gold. This type of action in momentum doesn’t necessarily dictate a bottom was in; we would want to incorporate other forms of analysis to get a better idea of the risk/reward.

RECENT RALLY MOVE

Some would argue that gold has caught a bid due to rumors of the Fed tapering in September, pulling back a portion of its QE program. First of all, I’m not concerned with the cause of price action, I follow what price dictates, but what’s interesting about this argument is we saw gold trek higher with each infusion of quantitative easing. So do the gold bulls get to have it both ways?

KEY LEVELS TO WATCH

Anyway, back to gold. This morning we are seeing a surge in gold prices with the fears of the U.S. attacking Syrian forces. Yesterday I was quoted in MarketWatch as saying $1417 was the level of resistance gold need to break in order for us to have a chance at seeing $1500/oz. I didn’t think we would be testing that level today, but it looks like the fear from the Middle East did the trick. This level is where we saw a slight bounce hit resistance in late-May and is also the 38.2% Fibonacci Retracement from the September ’12 high to the June ’13 low. This morning we had a few ticks above $1420 but as of this writing we are still testing $1417. We’ll see if any further news out of Syria could provide the juice to propel gold higher and begin a new uptrend.

Disclaimer: The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.

= = =

Related Story: Is War Good For The Markets?