This stock has been in the eyes of everyone this summer as their share price has skyrocketed throughout this year, from $34.40 (December 31, 2012) to a close on Thursday at $166.06, a total of 382% so far.

The company that was virtually left for dead during the financial crisis was resuscitated by its founder Elon Musk, who invested a significant part of his net worth to save the company.

TECH OR AUTOMOBILE

If we compare Tesla (TSLA) to other tech giants such as Google, LinkedIn and Apple during a similar period of their expansion, then the car company is a clear winner as its price has almost quadrupled in less than a year and is on its way to higher levels.

However, if we group Tesla inside the auto industry, we might not be that optimistic with the onward continuation of its rally. Although the company recently beat second quarter analyst estimates by $0.37 per share (actual $0.20/share vs. consensus estimate of $-0.17/share), they also reported a cash flow of -$78.71 million. This figure is much worse when you compare it to the big cats in the same industry: Ford Motor Company ($4.48 billion), General Motors ($2.35 billion) and Toyota Motor Company ($3.92 billion).

The good news for Musk is that the number of car sales keeps increasing, especially in California, where the company outsold many rivals like Porsche, Volvo, Lincoln and Mitsubishi, and is also currently receiving a good number of orders from Asia and Europe, increasing its international presence.

TRADING TSLA

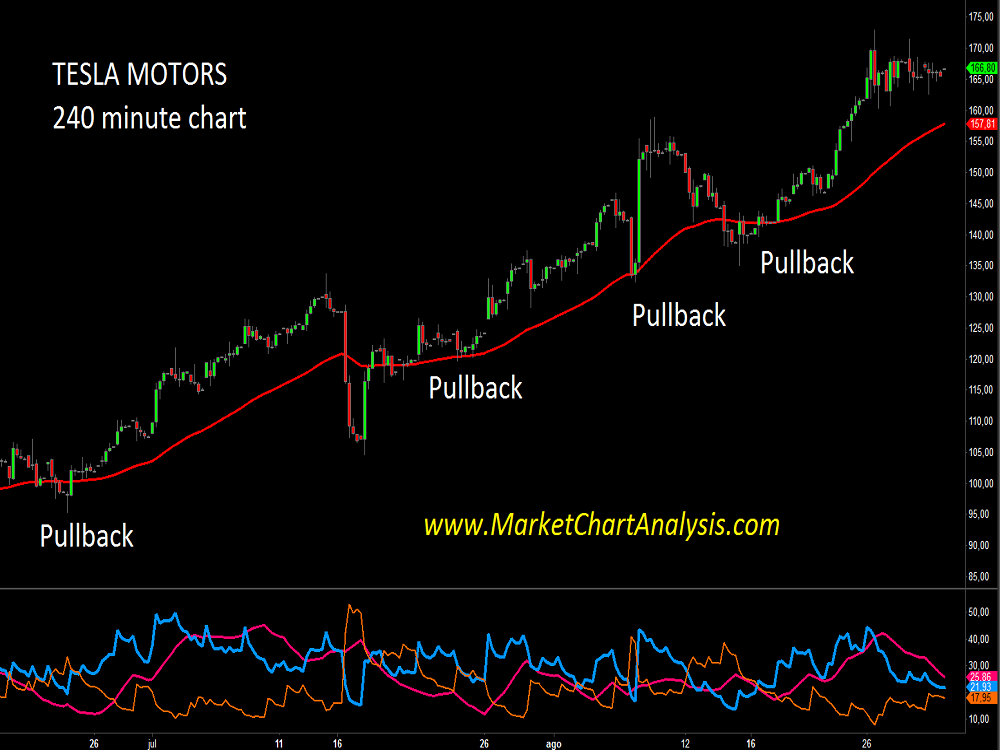

When looking at the chart, the easiest way to trade this stock is to use a 240-minute chart and wait for the price to return to the 55-exponential moving average (red line on the chart). Should it hold and turn around, that’s my entry. Should it not and slip below, then I’ll wait for a cross again.

THIS ONE IS WORTH WATCHING

If the market continues to look at TSLA as a tech stock, we might see the price crossing the $200 level this year and continue to surprise all of us. This would create a snowball effect and eventually become the new AAPL.

On the other hand, if it’s grouped back into the auto industry, we might not have such a pleasant surprise and instead see strong pullbacks.

= = =

[Have you been riding the TSLA wave? Or, what stock darlings are you eyeing? Share a comment below.]