In trading, position sizes can make the difference between ending the year in the red or the black.

This specifically applies to options trading, where there is inherent margin involved —you can basically buy or sell a hundred shares at a fraction of the cost.

Proper risk management encompasses two main aspects —the defined profit/loss targets, as well as the actual size of the trade. These two aspects are intertwined in an obvious way: the higher percentage of your portfolio you invest in one security, the more movements in that security will impact your overall returns.

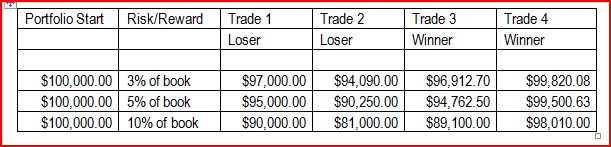

But, critically, sizing your positions correctly will help you navigate the bad trades that we all have, preventing you from “blowing up” and, ultimately, providing more opportunities to take advantage of opportunities. Below is a chart that simulates a book that makes two successful trades and two unsuccessful trades, using a 1:1 risk/reward ratio:

MORE RISK = MORE VOLATILTY

As you can see, using the same trades – but allowing yourself to “risk” more of your portfolio, you not only have larger volatility (down 20 percent after two trades), but you also will need to have more “winners” than losers to make up for the losses.

The portfolio that risked 10 percent of its book lost $2,000; the portfolio that risked five percent lost $500; and the portfolio that risked three percent was just $180 lower. Not only that, but such high volatility can put a strain on traders during those stretches that we seemingly can’t do anything right, potentially compounding bad decisions.

LET STOPS DEFINE THE POSITION SIZE

The second important thing to consider about position sizing is that it should be the last thing you decide on. That is, you should have a hard and fast rule for how much you are willing to risk, but risk should not impact your choice of where you put your stops. It should only impact how much you buy or sell.

Take, for example, an equity trading at $100 that you think is a buy with an upside of 20 percent or more. There are many ways that you could risk five percent of your portfolio. You could buy $100,000 worth and put the stop at $95, buy $50,000 and put the stop at $90, or buy $33,000 and put the stop at $85.

So, what is the trade? This is where your analysis, not your portfolio size, should inform your position size. If the only support you find is at $85, then put your stop there and only purchase $33,000 worth. If, however, you find support at $90, then you can put your stop there and invest more of your portfolio.

This trade-first approach is no different than in options trading, except that in options trading it is much easier to define the max risk and reward. I say that because in equities, prices can gap between the evening close and morning open, particularly if material news is released. In options, at most, your options could become worthless, causing you to lose the premium. This is the same in a debit spread, where you buy a call while selling a call at a higher price to help finance the trade.

In an options credit spread, where you actually collect premium, the most you can lose on each contract is the difference between the two strikes – which is also easily defined. (We do not recommend ever selling a naked call or put.)

At TradeSpoon we do not risk more than five percent of our portfolio on any single trade — and we look for at least a 1:1 risk/reward ratio. You may have a lower tolerance for risk, and that is ok. Just know what your risk is before you place the trade — and let the trade and risk define the position size, not the size of your portfolio.

#####

Related Reading:

Use Options, Not Stop Orders For Risk Management