We’ve recently heard news that Twitter, the seven year old social networking and micro blogging service company, is going public in a much anticipated initial public offering that some say could the biggest IPO since Facebook (FB).

Although the company may currently have less than $1 billion in annual revenue, estimates for the company’s post-IPO valuation range from $10 billion to $20 billion.

BIG MOVE

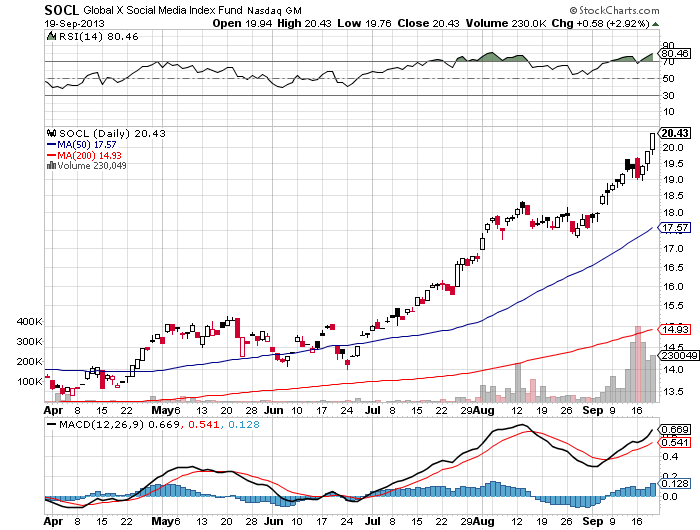

This will attract many bankers and especially the Global X Social Media Index ETF (SOCL) that has surged more than 50% this year.

Many analysts had dubbed this fund as the “Facebook ETF” since it was the first exchange traded fund to add FB to its holdings. The ETF quickly made room for Zuckerberg’s company in its portfolio, just five days after the IPO in 2012. Although it did not seem to be a great idea at that time, Facebook’s rebound has helped boost SOCL ETF to higher levels this year, becoming the most weighted stock in the ETF with a 12.2% portion of total holdings.

IT’S NARROW

It’s worth mentioning that SOCL is very narrowly focused and doesn’t include big technology companies such as Apple, Microsoft or IBM. However, it does invest in important stocks such as LinkedIn, Tencent and Sina.

THE PLAY

Will Twitter soar liked LinkedIn did in their IPO? Or instead will it have difficulties like Facebook had in theirs?

Either way, keep SOCL ETF in mind as it will rapidly grow once the tweeting company joins its league.

= = =

What do you think of the Twitter IPO? Post a comment below.