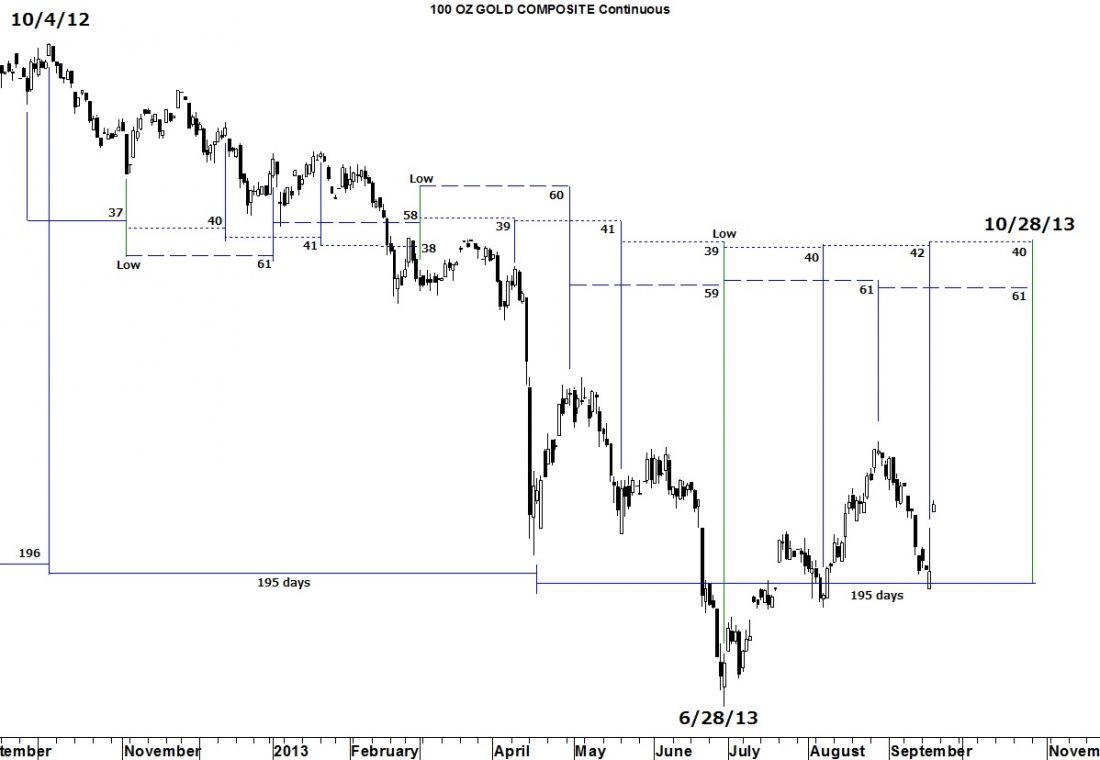

In last week’s commentary, I wrote that I was expecting a rally to begin based on a 40-day cycle pointing to a low the previous Friday. The bottom didn’t come until Tuesday last week but that was also the beginning of a 62 point rally.

TWO MORE CYCLES

This week I am adding two other cycles to last week’s chart— 60-day and 195 day cycles. Note how when the 40 and 60-day cycles converge they always point to a low in the price of gold. Therefore, I am moving up my target for a bottom in gold from 11/26/13 to 10/28/13.

KEY LEVELS

Gold is trading between the 8/28/13 high at 1,419 and the 8/6/13 low at 1,283. A break to the upside targets a minimum move to the May highs near 1,472 and will be gut-wrenching for bears. But by 10/28/13 the bulls will get their comeuppance as the October price target targets a bear market low at 1,160-1,170 (assuming no break out). If a break out to the upside does occur, the October price target drops to 990.

As usual, everyone will be too worn out at the bottom to want to be in the “game” any longer.

= = =

Request your free copy of the Special Report: Gold, Now It Gets Interesting at Seattle Technical Advisors.

= = =

Read a related story on gold here: