On Wednesday, Amazon.com (AMZN) announced their new Kindle Fire HDX tablets. Despite all of the buzz around the low price points, Amazon shares finished the day lower by 0.48%. Their market share in the market tablet space has actually declined in last year, going from 4.4% to 2.3% in Q2 2013. Since there are no major catalysts until Q3 earnings on Thursday, October 24, expect the stock to pullback or at best tread water in the next month.

TECHNICAL TAKE ON AMAZON

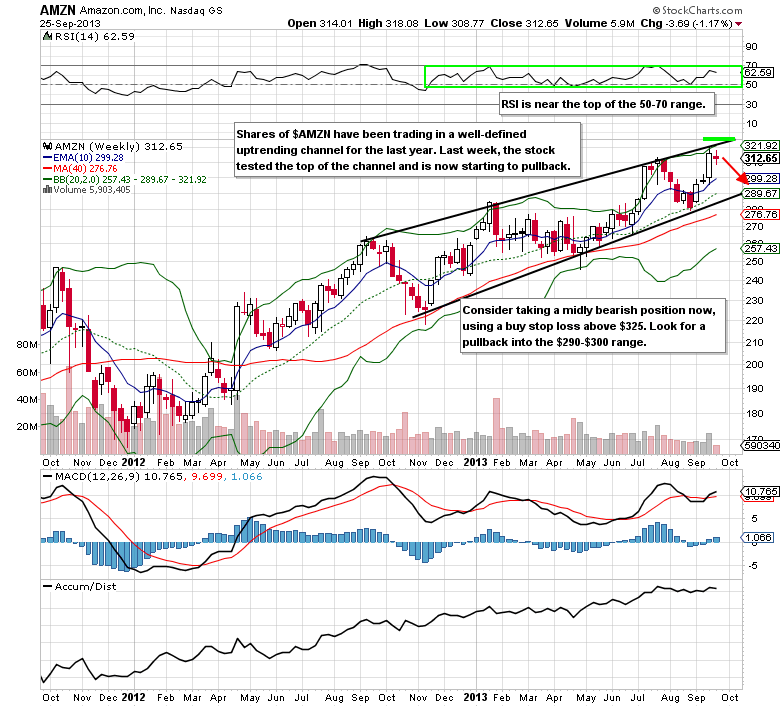

Shares of Amazon had risen over 12% from the August lows heading into Wednesday. In the last year the stock has been trading in a well-defined uptrending channel, but is now finding critical resistance in the $315-$320 range. Before making another sizable rally to new highs, look for a correction to $290-$300 or for it to consolidate long enough for the 100-day simple moving average to catch up to the current share price.

OPTIONS TRADE IDEA

Sell the (AMZN) Oct. $325/$330 Bear Call Spread for a $1.00 credit or better

(Selling the Oct. $325 Call and buying the Oct. $330 Call, all in one trade)

Buy stop loss reference- A move above $325 in the stock

Upside target- $0.00

Probability of a move above $325- 24.5%

Maximum risk- $4.00

Maximum gain- $1.00

= = =

Check out another trade idea from Mitchell here.

= = =

We’ve got a bullish and bearish views on AMZN. Read another story on Amazon published Thursday on TraderPlanet. Which do you agree with? Post a comment below.