We all remember Marilyn Monroe’s famous song “Diamonds are a girl’s best friend.” Today we can see how diamonds can become a trader’s good friend.

Recently gold prices have become very volatile and it seems to be losing value as a safe haven, so it’s time to seek other instruments that might fall into the same category of safe haven.

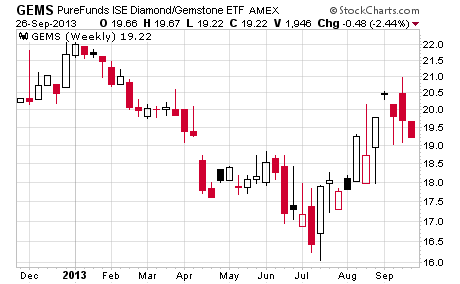

One of these instruments is a recently started ETF that was launched towards the end of 2012, which is PureFunds Diamond/Gemstone ETF (GEMS)

This is the first entrant in the exchange traded products space that offers traders exposure in the full life cycle of the gemstone industry. This fund invests accordingly in companies that are involved from the initial mining to retail distribution.

GROWING DEMAND

Two big companies in this industry have recently pointed out that there is a growing demand in this market that has been affecting positively their second quarter earnings: Tiffany (TIF) and Rio Tinto (RIO). Both have signaled that their data coming from Asia-Pacific influenced by lower gold prices have helped diamond demand.

UPCOMING SUPPLY

It’s been 10 years since a new major diamond mine with an output of at least one million carats annually commenced production. The last example is the Diavik mine in Canada’s Northwest Territories, which began commercial production in 2003. The project’s economic open-pit depth has already been reached and has since been converted to an underground mine with only about 7 years left of production.

Not to worry. There are new projects and even better prospects on the horizon.

The first is the Grib project in Russia, which is estimated to produce about 4 million carats annually commencing towards the end of 2013. This project has an estimated mine life of about 20 years.

Secondly, we also have Canada’s Northwest Territories Gahcho Kue mine, which is estimated to produce 5 million carats annually for at least 15 years expected to start in 2015.

STRONG POINTS

Despite the weakness in the commodities market, diamond prices are shining and solid, supported by the rising middle class in the emerging markets. While there is no physically backed diamond fund, investors can still gain exposure to this asset through this miners exchange traded fund.

The recent earnings season showed that long-term Asia demand continues to support the diamond industry. China has become the second largest jewelry consumer in the world from fifth largest over the past eight years.

WEAK POINTS

The ETF remains small at the moment, with about $1 million in assets under management and averaging 9,000 shares traded daily, but this is quite normal given the limited live track record and general “newness” of the fund in the marketplace.

This low-volume impacts the visual bid and ask spread making them often quite wide, creating pricing inefficiencies.

COMPARISON WITH GLD ETF

Many houses are currently studying the possibility of creating another fund that’s physically backed by diamonds hoping that it will generate the kind of attention gold ETFs have garnered. But unfortunately, a skillfully financially engineered product like GLD cannot be copied so easily and definitely won’t fit so neatly into an ETF wrapper.

BOTTOM LINE

Although trading in the diamond industry looks to be very difficult and costly, it’s nice to know that the market has made room for an instrument such as GEMS for us to gain access to this sector.

Keep this ETF in mind and track it as it keeps attracting volume and new investors.

= = =