“The most important thing to remember is that inflation is not an act of God, that inflation is not a catastrophe of the elements or a disease that comes like the plague. Inflation is a policy.” —Ludwig von Mises

We are faced with an interesting quandary for the U.S. dollar. Generally when a country has a debt issue or a budget issue or some other government caused and unsolved problem, the result is buying dollars for perceived safety. With the debt limit being reached, the un-Affordable Care act being rehashed, and the current budget debate being debated, the U.S. is the one with the problem. So, should the dollar benefit from our government’s inability to fulfill its basic mandate? I’m not sure. But yes, probably.

HOW THIS REALLY WORKS

Let’s talk about what should happen then about what is likely. First off, the U.S. government is not going to default on its debt obligations unless politicians decide to let it. Look at the national economy like any other corporation. The debt servicing cost to income (tax) ratio is pretty small. (Isn’t it interesting how little this simple computation for analyzing the strength of a corporation is being discussed in regards to our nation?) Therefore, the notion that the U.S. will default on its debt (how many times have we heard “unless congress acts, the U.S. will not be able to pay its debts”) is political fear mongering and just plain wrong.

CUT OUT NON-ESSENTIAL ITEMS FIRST

When a company has a cash flow problem, they cut back on nonessential operations first. They don’t default on their bank loan.

In a small company, the coffee pot might go. (Though, that’s really more a psychological move than financial one as well. What does coffee cost?) Company picnics, happy hour outings and holiday parties are next on the chopping block. Only on a federal level is spending $750,000 on a new soccer field for detainees at Guantanamo; subsidizing an already financially sound business like PBS; or spending $2.2 million to study “why lesbians are obese” more important than paying the bank a mortgage payment.

And the market knows that. Otherwise we would have seen the dollar get pummeled instead of this gradual fade.

So, the current manufactured crisis will have an effect on the dollar. But, I can’t predict how when or if the government will fix (kick the can down the road again) things. If the problem were actually solved, we would likely see a rise in equities and general risk assets and a selloff in the dollar. On the other hand, any delay in fixing the problem will still likely drive money into bonds, out of risk assets, and hence into the one asset that, if all other things were equal, should be an indication of the strength of the nation as a whole. But in our case things are a little backwards.

THE CHART

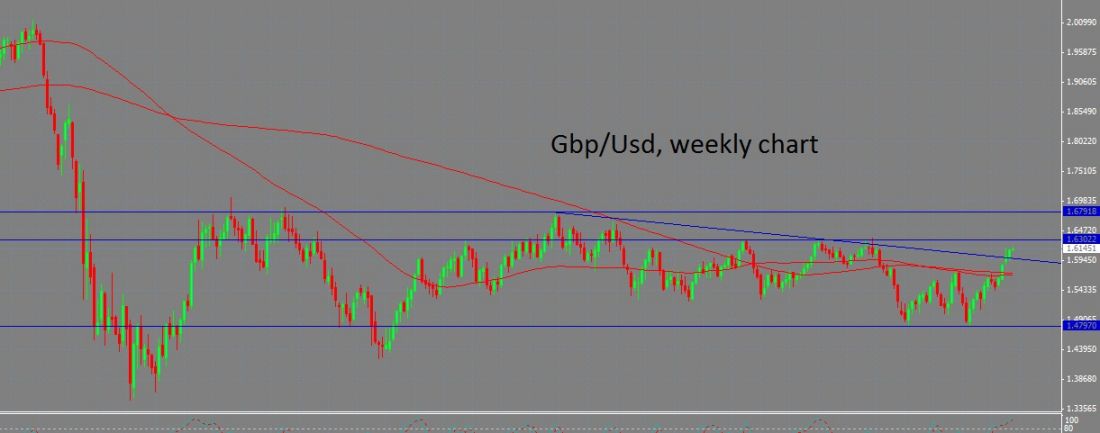

On the technical side however, things look a little weary for the dollar. Take a look at the monthly bull candle on both the EUR/USD and GBP/USD. That doesn’t look healthy for dollar strength. We are approaching the upper range of a multi-year post-2008 crash range in the gbp/usd. On the euro front, we’ve broken from one weekly trendline and seem headed higher. So, regardless of our macroeconomic circumstances, while buying the dollar at these levels may seem a good deal, it is a very counter-trend move.

You can get rich picking a top, but you have to not go broke first.