There may be utter turmoil in our nation’s capital but don’t tell that to the IPO market. It continues to churn out winners, the latest being two names that many are familiar with.

On October 2, RMAX and BURL made their debuts. Considering the headline noise coming out of Washington D.C., their IPOs performed exceptionally well. Further, unlike some recent technology IPOs – like FireEye (FEYE) or Rocket Fuel (FUEL) – the strong pricings were no slam dunk given waning enthusiasm on housing stocks and mounting concerns over retail sales.

RMAX: COUNTRY’S LARGEST FRANCHISOR OF REAL ESTATE BROKERAGE SERVICES

RE/MAX (RMAX) has had the #1 position in the U.S. and Canada in terms of number of transactions completed since 1999. After 40 years of operating as a private company, RMAX went public via its 10.0 million share IPO which priced at $22 versus the $19-$21 expectation. The positive sentiment carried into the public markets as it opened for trading at $26.22, 19% above its IPO price.

The company operates under a franchise organizational model with four tiers (RE/MAX, Regional Franchise Owner, Franchisee, Agent) with nearly all branded brokerage offices operated by franchisees. The majority of revenue is derived from franchise fees (39%), annual dues (20%), franchise sales (16%), and broker fees (14%).

HOUSING RECOVERY SPURS BETTER GROWTH

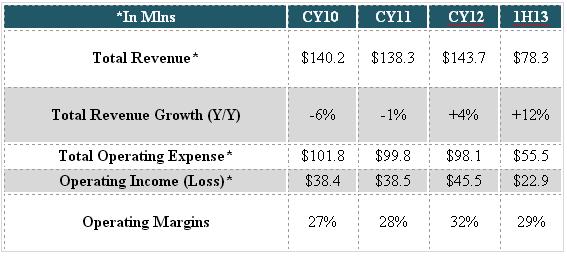

After posting top line declines since the real estate fallout, RMAX returned to growth last year. Revenue for the six-months ended June 30, 2013 was up 12% y/y to $78.3 mln.

Operating margins are a standout metric for RMAX at a healthy 29.1% in 1H13. The company is profitable with a net profit of $15 million for this period and Adjusted EBITDA grew 25% y/y to $36.7 mln.

On the balance sheet, RMAX will have ~$61 million in cash on hand after the deal. Still, the company will have quite a bit of debt with ~$223 million on the books.

CONCLUSION

RMAX’s strong debut illustrates that investor sentiment for the housing sector remains positive, despite some waning enthusiasm. It is also a testament to RMAX’s strong brand name, leading position, and improving financials.

Compared to peer Realogy (RLGY) – the owner of Coldwell Banker & Century 21 – RMAX has much stronger margins & better topline growth rates. It also plans to pay a modest annual dividend of $0.25/share while RLGY does not currently offer one.

In short, although it has a premium valuation, RMAX appears to be the better choice between the two & for investors looking to gain exposure to the housing market, RMAX provides a solid option.

BURL: A TURNAROUND COMPANY WITH AN ATTRACTIVE VALUATION

While most eyes were on RMAX, the surprise winner of the day was Burlington Stores (BURL). Its’ 13.3 million share IPO priced at $17, above the $14-$16 expected price range, opened for trading at $23.04, and closed at $25.11, good for a 48% gain from its IPO price.

BURL is a discount retailer that was formerly known as Burlington Coat Factory. It was taken private by Bain Capital in 2006, and once acquired, Bain began a restructuring program that streamlined operations, refocused their merchandise, and returned the company to growth.

BURL operates over 500 stores in the US and Puerto Rico that sell coats and apparel, footwear, accessories, and home goods. Merchandise is deeply discounted, up to 60-70% off department store prices. The company’s stores are very large — two to three times larger than its competitors’ stores — which allows BURL to feature merchandise from over 3,500 vendors.

RESTRUCTURING & NEW GROWTH INITIATIVES DRIVE TURNAROUND

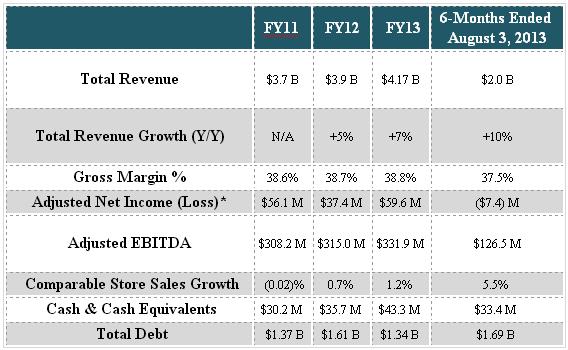

Although growth investors may not be overly impressed, BURL’s financials and growth rates are on the rise. For FY12, sales grew 5% to $3.89 bln, and sales growth accelerated somewhat to +7% in FY13 to $4.17 bln. This modest acceleration has continued into FY14, with 1H14 sales up 10% to $2.04 bln.

Same store sales have been moving in the right direction in recent periods too, from +0.7% in FY12 (Jan), to +1.2% in FY13, to +5.5% in 1H14, to +7.8% in 2Q14.

Since FY09, gross margin has held steady in the 38-39% range. On a GAAP basis, the bottom line has fluctuated between net income and net losses, but the company generated positive cash flow from operations in every period provided in the prospectus spanning FY09-1H14.

CONCLUSION

Fundamentally, BURL has a lot going for it. The restructuring actions taken over the past few years are paying dividends as its topline growth and comparable store sales growth have been improving.

BURL also has some catalysts ahead. It plans to open 25 new stores annually, believing that it can double its store base from 500 to 1,000 over time.

What also stands out is its valuation with a trailing P/S of only 0.4x FY13 revenue. That is well below peer Ross Stores (RST), at 1.6x. With that said, given the sharp spike higher, it may be prudent for new investors to wait for a pull-back as short-term traders flip out of the IPO to lock in gains.

= = =

Read the TraderPlanet interview with IBD’s Bill O’Neil to learn the basics on his long term growth stock investing strategy.