Contrary to popular belief, studying the yield curve isn’t just for bond investors and traders.

While the most widely scrutinized curve plots out the interest rates among U.S. Treasuries of varying maturities, it does not mean that only investors of those bills, notes, and bonds can gather useful information from the curve to help make investing decisions. Investors of dividend stocks, and all other sorts of equities, can utilize the yield curve to help inform investment decisions. This is because the curve outlines future interest rate and economic growth expectations, which can have a meaningful impact on how investors–both individual and institutional–invest in various dividend stocks, and thus give investors an idea of the future performance of a number of different equities.

WHAT IS THE YIELD CURVE?

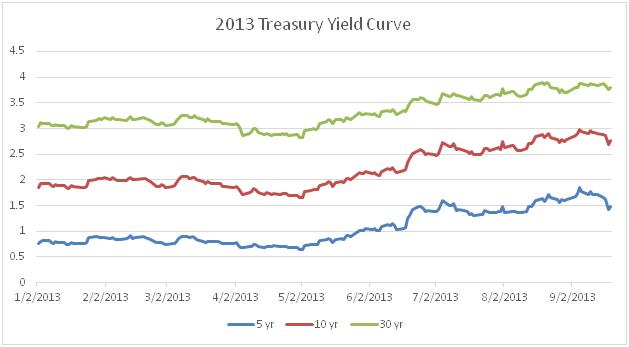

First off, let’s establish exactly what the yield curve is and what it measures. The yield curve is a graph that plots out the interest rates at a given point in time of fixed-income securities of equal credit quality but different maturity dates. Normally, and for our purposes here, the yield curve measures the relationship of U.S. Treasury debt of varying maturities, from 1 month to 30 years. The yield curve is used to show how bond investors expect interest rates and the economy to perform in the future. Because it is dependent on the reactions of market participants, the yield curve is always fluctuating.

TYPES OF YIELD CURVES

Essentially, there are three types of yield curves. While each curve might have a different slope, there are really only three curves that equity investors need to worry about when assessing the future of interest rates, the economy, and potential stock investments.

• Normal: This is when short-term rates are low and long-term rates are high. In a normal yield curve environment, it means that bond investors see little risk in short-term debt, with a bit more risk in long-term debt. On the whole, normal yield curves measure a point in time where investors believe the economy is growing and will be relatively stable in the short-term.

• Flat: This is when short-term and long-term rates are about the same. We see flat yield curves in a transition period from a booming economy to an economy on a downswing, or vice versa.

• Inverted: This is when short-term rates are at a larger level than long-term rates. This tends to come when we are in the midst of a recession or if investors expect a downturn in the economy. If short-term rates are large, that means investors believe there is risk in the market in the near future.

Keep in mind that the Federal Reserve also plays a role in determining how interest rates react, and thus plays a role in the shape of the yield curve. Typically, the Federal Reserve will push down interest rates during a downturn in the economy, or as the economy is recovering from a downturn (sound familiar?). Conversely, in a booming economy, the Federal Reserve will raise interest rates in order to control prices and inflation.

HOW THE YIELD CURVE CAN HELP INFORM DIVIDEND INVESTING DECISIONS

Ok, great, but now you may be thinking, “How does this help me as a dividend investor?” Well, the future of Treasury yields, interest rates, and the economy have a big effect on the future performance of dividend stocks. For instance, in a steep, normal yield curve environment, with long-term rates at high levels above the average stock’s dividend yield, it might mean that some long-term income investors will rotate out of traditionally high-yield dividend paying sectors like Utilities, Telecoms, and MLPs and invest in “safer” assets like US Treasuries due to their perception of safer and less risky returns. As such, a dividend investor might see a dip in their high-yield dividend equity investments and their portfolio might underperform the market if this develops.

On the other hand, in an economy that is on a downturn and long-term interest rates are low, income investors might find it to be an opportune time to put money into dividend stocks with attractive yields in stable sectors like Utilities, Telecoms, and Consumer Staples. Moreover, in an inverted yield curve environment, stocks of companies that are not interest rate dependent, meaning they do not take out much debt, tend to thrive versus the overall market.

THE BOTTOM LINE

If dividend investors are able to properly study the yield curve and anticipate where the market might take their holdings, it could lead to substantial gains over the long-run. Though at Dividend.com we advocate that investors utilize a buy and hold strategy for long-term wealth building, it still pays off to assess the yield curve to help make certain investment decisions when reallocating a portfolio every quarter or year. The beauty of dividend investing is that investors will see some sort of returns through dividend payouts even in a fluctuating market. But even so, by studying the yield curve, investors can stay one step ahead of the game to ensure that we see both dividends and significant share price appreciation.