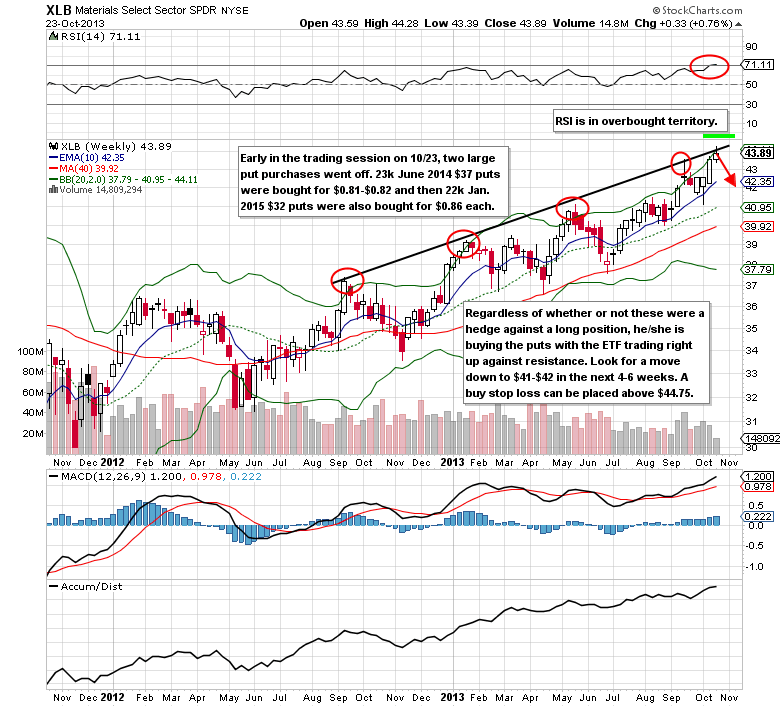

Shares of the Material Select Sector SPDR (XLB) remain an underperformer in 2013 with a gain of 15.41% vs. the S&P 500’s year to date gain of 19.09%. On the back of Tuesday’s fresh 52-week high above the $44 level, heavy put activity hit the XLB on Wednesday, October 23.

In the first twenty minutes of trading, nearly $4 million worth of put premium was purchased. 25,000 June 2014 $37 puts were bought for $0.81-$0.82 and then 23,000 Jan. 2015 $32 puts were bought for $0.86 each. The put to call ratio finished the day at 14.06.

Technicals Of The XLB

The XLB has steadily been trending higher for the last two years. However, in the last three weeks of trading the ETF has rallied nearly 7% from the lows pushing up towards a near-term resistance. RSI is also in overbought territory above a 70 reading. Before seeing any sizable gains above $44, we’ll likely see a retest of the $41-$42 support level.

Material Select Sector SPDR Options Trade Idea

Buy the Dec $41/$44 put spread for a $0.95 debit or better

(Buying the Dec $44 put and selling the Dec $41 put, all in one trade)

Stop loss: none

Upside target: $2-$3

= = =

See Warren’s free trade of the day featuring General Electric (GE) here.