Ever since Facebook (FB) went public in May 2012, Twitter (TWTR) found itself in the spotlight as questions persisted about when the company would finally push forward with its own IPO. That speculation is now over as the last of the major social media companies is set to open for trading on November 7.

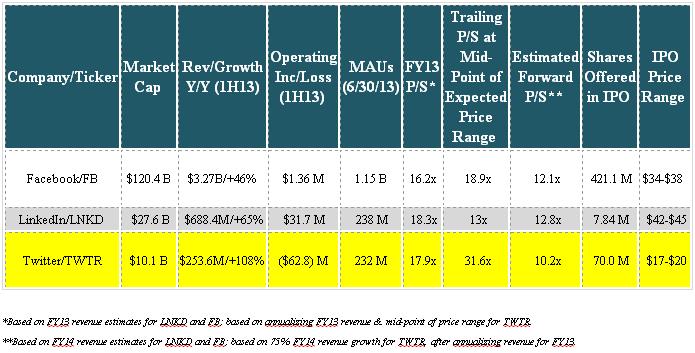

While a large deal at 70.0 million shares, it still pales in comparison to FB’s whopping 421.0 million share offering. The expected price range is also significantly lower at $23-$25 (originally $17-$20) versus $34-$38 for FB. These two differences should work in TWTR’s favor as there will be less supply to be soaked up, and the perceived valuation is more attractive.

Another key difference is that TWTR is earlier in its growth cycle than FB, illustrated by its higher revenue growth rates and smaller user base. It isn’t profitable, which is a notable blemish, but given the more attractive deal specifics and better growth potential, we think TWTR should find very strong institutional demand.

A Closer Look at TWTR

TWTR is a highly popular social media company, but unlike FB, which provides a much more extensive platform, TWTR’s platform is uniquely simple. Tweets are limited to 140 characters of text, and that brevity offers a couple key advantages.

For instance, short messages are highly compatible to live events, when people want to quickly share information about an important event. But perhaps more importantly, these quick messages are well-suited for mobile use. In fact, TWTR states that 76% of its users primarily access it through a mobile device and 71% of its advertising revenue is generated from mobile.

Twitter’s user base has grown rapidly with about 230 million monthly active users as of September 30, 2013, up about 39% year/year. That is only a fraction of FB’s 1.1 billion+ user base. Of course, TWTR argues it has more runway for growth, noting that it is less than 10% penetrated across the globe. Lastly, one interesting item about its user base that people may not realize is that 77% of its users are international.

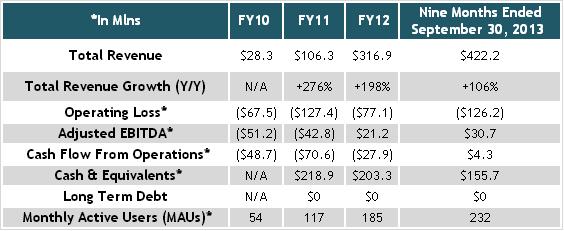

The Financials

The topline is what most investors will focus on, and the growth there has been exceptional. Revenue has been growing by triple digit rates, but has naturally been slowing as its revenue base expands.

On an operating profit basis, TWTR is not profitable, nor close to being profitable. However, it is cash flow positive over the first nine months this year, and turned profitable on an Adjusted EBITDA basis last year.

Our thought process is this: Of course it would be preferable if TWTR was already, or close to being profitable, and its lack of profitability is a blemish on its fundamentals. We think greater credence will be given to its revenue growth and growth potential, its valuation (especially compared to FB), and the make-up/specifics of the deal.

Taking a look at its results for the nine months ended September 30, 2013, revenue jumped by 106% year/year to $422.2 million. The growth was mainly attributable to a 67% increase in timeline views driven by a 39% bump in average MAUs. Also, advertising revenue per timeline view was up 32%, attributable to a 271% increase in ad engagements per timeline view.

How TWTR Stacks Up

Undoubtedly, TWTR will be linked with FB and will be thoroughly compared and contrasted. Looking at the data above, TWTR stacks up favorably in some key aspects, but, it is clearly lagging in another — profitability.

First, the positives. Its topline is growing much faster than both FB and LNKD as the company is more in the upswing of its growth curve. It also has had more early success monetizing mobile devices than FB, which has boosted its revenue growth.

The bad news is, TWTR is nowhere near profitability while both FB and LNKD are profitable. In fact, both FB and LNKD were profitable at the time of their IPOs. With that said, TWTR is generating positive cash flow and Adjusted EBITDA, and investors may not focus on its bottom line at this early stage.

Conclusion

We like the make-up of this deal more than FB’s back in 2012. The float is much more reasonable and we don’t think the deal size will be maximized and continually increased, as was FB’s. Additionally, as some may recall, just before FB went public it released an updated S/1, warning that its mobile segment was chipping away at its profitability. We wouldn’t expect a similar event to occur with TWTR.

To be clear, though, the fundamentals are far from perfect and there are risks. The blemish that sticks out like a sore thumb is its operating losses. The company is losing a lot of money, and that amount is growing due to its heavy investments in technology and sales force.

But, TWTR’s valuation, the lower expected price range, smaller deal size, and higher growth should outweigh the lack of profitability in our opinion – especially since a good portion of its losses are due to non-cash items like depreciations and stock-based compensation.

= = =

What do you think of Twitter? Will you be jumping in on the trade?