Forex pairs are not created equal. Some move while others slumber. Some cost a fortune to trade and others a mere dime. Some violently kill you with evil slippage while others are more kind.

This varied temperament and costliness of different forex pairs are what affect their timeframe suitability. In this article I explain why forex pairs are suitable for different timeframes.

MOVEMENT MATTERS

To make money a forex trader needs the currency pair to move in the favored direction. Without movement we can’t make money.

Each forex pair varies by how much it typically moves each day. Some move a large number of pips while others move much less.

SPREAD VARIES

Also variable is the spread of the currency pair. That is, unless the forex broker you trade with is artificially fixing it.

The spread is the difference between the offer price to buy the currency and the bid price to sell. The spread is always a cost. When you enter a trade by buying or selling you’re always instantaneously in a loss by the cost of the spread. The price needs to move by the amount of the spread in the favored direction to reach breakeven.

TIMEFRAMES IMPACT COST

Forex traders typically have a timeframe as their execution timeframe. That is the timeframe that we use to select our entry, stop loss and other exits.

Higher timeframes require a larger number of pips of movement whereas the same system on a smaller timeframe needs much less.

For example, a weekly trade may last weeks with hundreds of pips of movement required to take it to a profit target. Compare that with a 5-minute forex trading system that will be lucky to last an hour.

The spread stays the same regardless of the timeframe you’re trading. It’s totally impartial.

So forex trading systems using higher timeframes cost less to trade than lower timeframes. The spread as a percentage of the distance between the entry and stop loss, which is the usual basis for calculating position size, is larger on small timeframes.

The increased cost to trade is what makes small timeframes more difficult to trade profitably, all other things being equal.

GATHERING DATA

The average daily movement of a forex pair is a way to assess the approximate movement potential of each forex pair. When this is compared with the spread it gives an idea of the potential relative cost of trading one forex pair versus another.

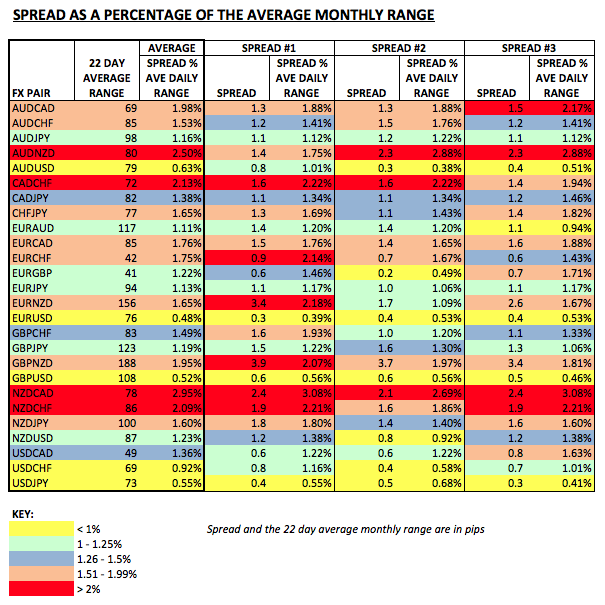

In this table below I’ve taken 3 snapshots of the spread within a minute of each other at a very liquid time during the European session. I’ve taken 3 snapshots to get a representative average rate. The spread excludes the cost of commission.

As 22 days equates to the average number of trading days in a month, I’ve taken the average daily range for the last 22 days. This provides information on the recent movement in the currency pair.

When trading small timeframes forex traders are looking for a smaller number of pips. This causes the cost to trade to be greater as the spread represents a larger percentage of the overall trade size.

This is why forex scalping, where small numbers of pips are traded, are usually only done on the major USD forex pairs.

KEY POINTS TO NOTE

Here are some key points to note from the analysis and my experiences:

• The USD crossed pairs EURUSD, GBPUSD, USDJPY, AUDUSD and USDCHF are the cheapest to trade and the most suitable for short sessional based forex trading.

• As the trading timeframe length increases, more forex pairs become progressively viable.

• Some forex pairs may not be deemed suitable on any timeframe with the forex trading system(s) you’re executing.

• More liquid forex pairs generally have a lower relative spread cost.

• My experiences indicate that forex pairs with higher spread are often associated with greater slippage.

• The average movement of each forex pair changes over time with volatility. This impacts the cost to trade.

TAKEAWAY

Matching forex pairs to suitable forex trading system timeframes can improve your performance. The cost to trade is the first hurdle to overcome to achieve profitability.

Review your forex pairs to ensure your choices set you up to succeed.

#####

RELATED READING