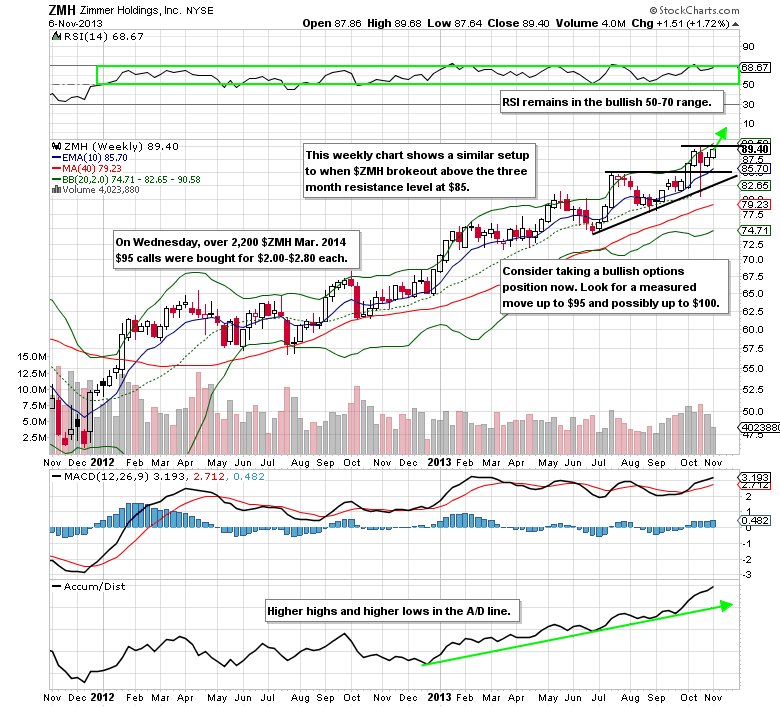

On Wednesday, November 6, the call to put ratio in Zimmer Holdings (ZMH) options was heavily in favor of the bulls at 12.54. Most of the action was in the March 2014 $95 calls, which were bought over 2,200 times (roughly $500,000 worth of call premium). Looking at the fundamentals, Zimmer Holdings beat Q3 EPS and revenue estimates in October. This puts the company on pace for year over year EPS growth of 7.74%.

The Technical Take On Zimmer Holdings

Following the release of their Q3 results on the morning of October, 24th, shares of Zimmer Holdings initially gapped lower by nearly 10%. Since then the stock has recovered almost the entire post earnings decline and is poised for a breakout of the key $90 resistance level. Look for shares of the Indiana based medical device maker to trade up to $95-$100 in the next couple of months.

Zimmer Holdings Options Trade Idea

Buy the Jan 2014 $90/$100 call spread for $2.50 or better

(Buying the Jan 2014 $90 call and selling the Jan 2014 $100 call, all in one trade)

Stop loss- None

Upside target- $5.00-$10.00

Check out my free trade of the day featuring Las Vegas Sands (LVS)

= = =

“Like” TraderPlanet on Facebook to receive daily market updates and insights.