Many traders like to take into account the seasonality effect in their investments. They look for certain patterns that repeat themselves throughout the years and try to take advantage of them.

During the month of November, the cyclical ETFs such as consumer discretionary, industrials and materials funds are usually good places to put our money.

NEW OPPORTUNITY

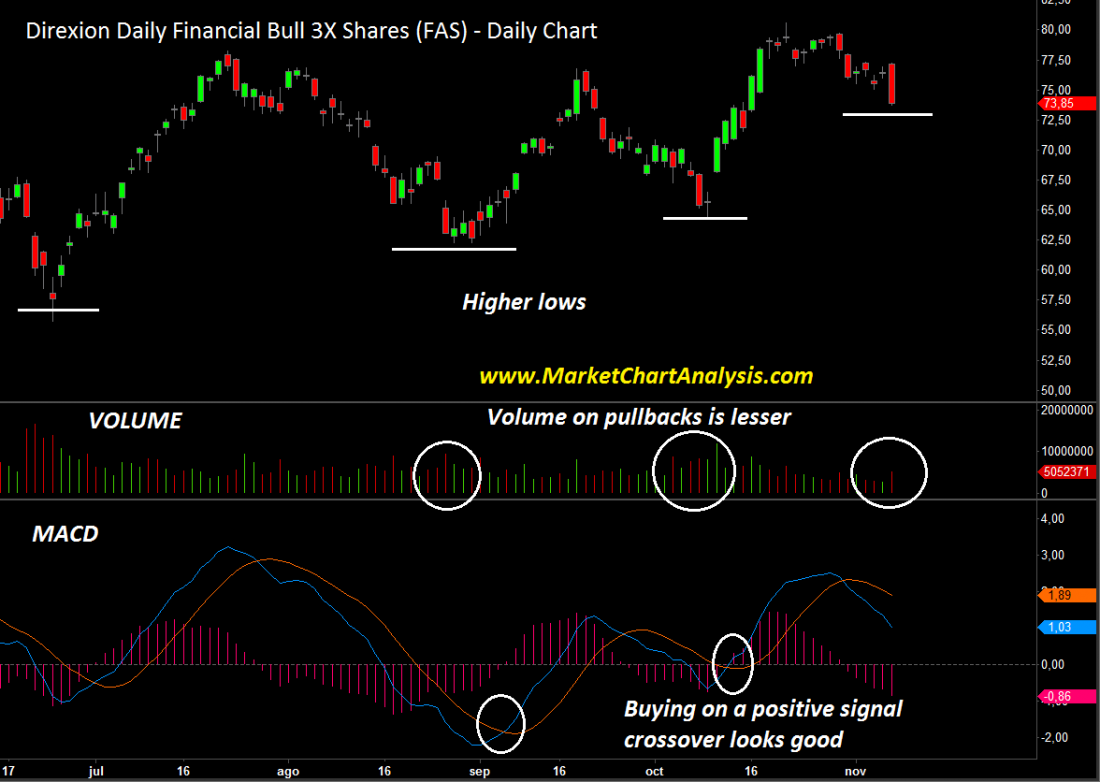

However, this time there is another ETF on the horizon that could explode upwards and help us grow profits in our accounts. This is the case of the Direxion Daily Financial Bull 3X Shares (FAS).

FAS attempts to deliver three times the daily performance of the Russell Financial Services Index that includes stocks such as Bank of America (BAC), Citigroup (C), J.P. Morgan Chase (JPM) and Goldman Sachs (GS).

This exchange traded product has been moving around in a narrow range for the past few months with a positive reading on its chart. The lows are each time higher and involve less trading volume when they happen. This is a bullish sign since it means that the sellers are staying away while the buyers are merely taking a rest.

TIME THE ENTRY

Now all we need to know is when to enter this ETF as timing is one of the most important factors for successful trading. One way to get a correct entry level is to use the MACD indicator and go in with a positive signal crossover.

Just remember that this ETF is 3 times leveraged and therefore it does carry a certain amount of risk higher than the average ETF play.

= = =

“Like” TraderPlanet on Facebook. We want to hear from you!