“Actions speak louder than words but not nearly as often.” —Mark Twain

By now, we’ve all heard talk from the euro zone about deflating the value of the Euro. Until something substantially changes however, you probably shouldn’t believe everything you hear. We’ll read about forecasters and prognosticators talking about the likelihood of lowering some interest rate or turning on a printing press somewhere sometime, maybe. But until words become actions, the tradable event is generally short lived.

BUYING OPPORTUNITY

For example, how many times have we heard someone somewhere talk about the end of the Fed’s quantitative easing program. Each time someone reputable gets on the horn and suggests a taper or elimination we have a little hiccup. But until the Fed actually pulls the plug, this should be looked at as a buying opportunity, not a selling one.

THIS IS A BULL

Heck, the S&P is up 35% from a year ago today. Like it or not, this is the very definition of a bull market. We can argue later whether it’s a bubble bull, or healthy bull, or some other kind of bull and one of those is probably right.

TAKE THE LONG TERM VIEW

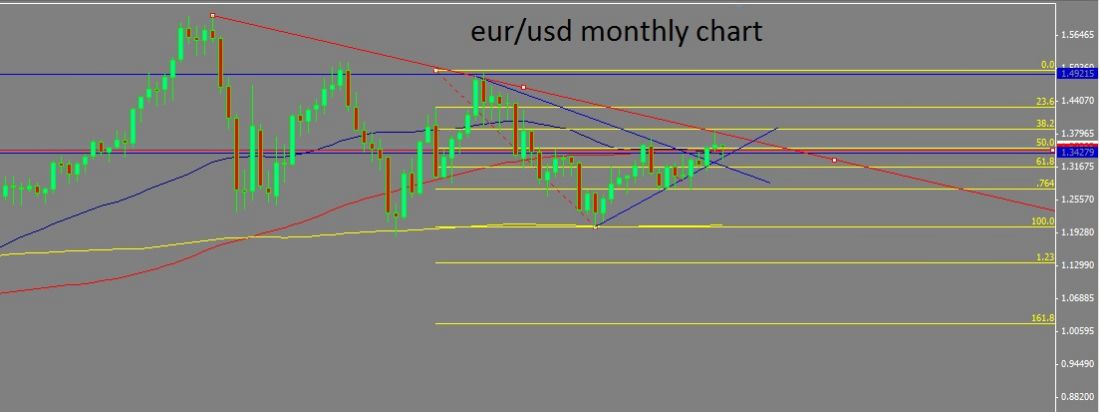

Now, apply that reasoning to the noise we’ve hear coming from Europe about the strength of their currency. Take a step back and look at a few long term charts to get perspective. Weekly and monthly charts on euro crosses look unconvincing in their bull movement at best or consolidative and confused at worst. Compare the euro dollar movement now to what we saw in the bull move that started in 2001. That was a market with some direction.

KEY LEVELS

In the long run, the euro may be ready to top out a little. With these larger moves, levels are a bit subjective. But, since well before the crash of 08, the euro has been defined by the 200 month moving average on the bottom, and ever lower highs on the north.

Technically, we are playing with a fairly significant monthly trendline and the .618 retracement of the prior monthly swing move lower in the pair. This is hardly reason to switch our trading bias from bullish to bearish, but it is probably a good reason to be cautious of further gains in the pair.

THE TRICK

But, like I said in the beginning, markets really need a pretty good reason to change what they’re doing. The trick is in figuring out what that really good reason was after it happened and learning how to differentiate it from the noise.

= = =

We are taking a poll: What did you learn from your biggest losing trade? Join the conversation on our Facebook page here.