As I’ve said in previous articles, 2013 hasn’t been the year for commodities, at least not from the long side. Today I want to focus on one commodity that seems to be showing signs that bulls might be interested in. While commodities as a whole are down nearly 10% this year, cotton is basically flat. So it’s not the ugliest pig in the pen which makes it a candidate to lead if we see commodities come back from the doldrums.

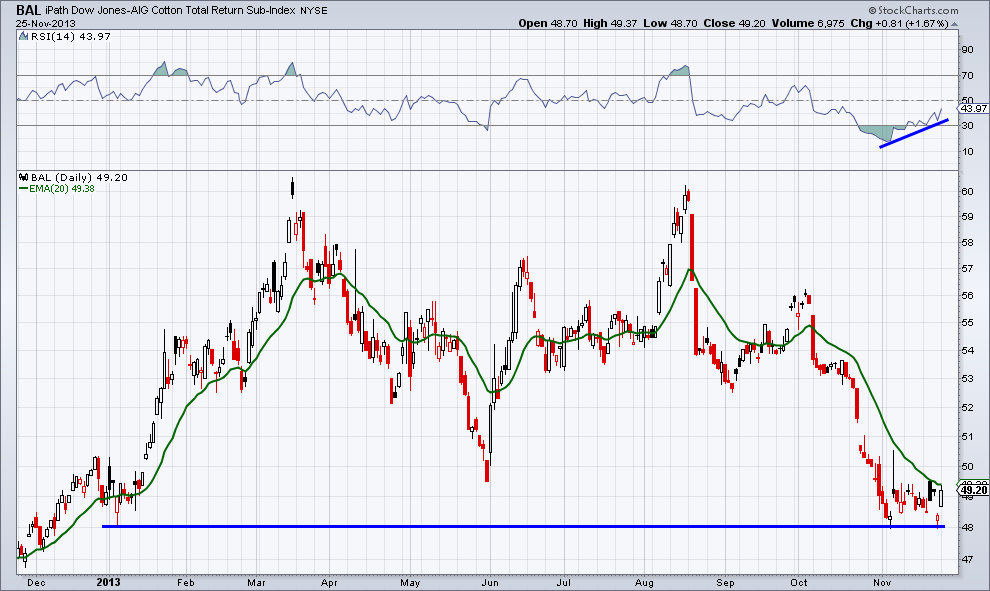

Below is a chart of the iPath Dow Jones Cotton ETN (BAL). As you can see in November we have found some support at the previous 2013 low. Over the last few weeks we’ve tested the $48 level twice while the Relative Strength Index, show in the top panel, has been rising. These types of positive divergences in momentum indicators are great signs that selling might be getting exhaustive. On Monday we saw strong price action as BAL tested its 20-day exponential moving average (EMA). If we see a break of this moving average with strong volume then we could see the start of a trend change for the cotton market.

Seasonality can be a big factor when it comes to commodities, and cotton doesn’t escape this. When looking at the average price action over the last 5 years, 10 years, 15 years, and even 20 years, its low point for cotton is often found in November with prices rising on average until March.

Taking a look at sentiment, the Public Opinion data from SentimenTrader shows that sentiment for cotton is at historic lows. We are now at levels last seen at the low in 2012 and during the financial crisis in 2008. It seems no one is a big fan of cotton, which adds to our point that cotton bears may be running out of sellers joining their sleuth.

To wrap things up, we have a positive divergence in momentum as price attempts to find support at a previous low. Seasonality is now in the bull’s favor along with sentiment being at a historical extreme. This group of bullish data doesn’t mean we see cotton shoot right back up to the year’s high, there’s still a large hill for cotton to climb and I’ll be watching to see if price is constructive in the bullish lens. We’ll see where price action takes us.

Disclaimer: The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.

RELATED READING

Read another story by this author