With the holiday season and year end approaching, the IPO market looks poised for one more flurry of deals before firms close their books on 2013. Among the twelve confirmed upcoming IPOs is one more headliner that is sure to generate plenty of interest.

Hilton Worldwide Holdings (HLT), the world’s largest hotel company with over 4,000 properties worldwide, is set to go public on December 13, offering 112.8 million shares within a range of $18-$21. Given the prominence of the IPO, it’s not surprising that Wall Street’s top firms are leading it: Goldman Sachs, Morgan Stanley, Deutsche Bank, and BofA Merrill Lynch.

To rewind a bit, Blackstone Group (BX) purchased the company for $26.0 billion in October of 2007. Since then, HLT has undergone a fairly significant transformation under a new management team, headed by Christopher Nassetta, its President and CEO.

For instance, between June 30, 2007-September 30, 2013, it has increased the number of open rooms in its system by 36%, representing the highest growth of any major lodging company. It has also shifted its business model to focus almost exclusively on building out its higher margin franchise business.

Before discussing its operations in more detail, It should be noted that BX is not selling any of its stock at this time, and will hold about 750.6 million shares, or a ~76% stake following the offering.

A CLOSER LOOK AT HLT

HLT’s flagship brand is Hilton Hotels & Resorts, but it also owns a portfolio of premier brands including luxury names Waldorf Astoria & Resorts and Conrad Hotels & Resorts, full service hotel brands such as Double Tree and Embassy Suites Hotels, and a line of focused-service hotel brands including Hilton Garden Inn, Hampton Inn, Homewood Suites, and Home2Suites.

The company operates through three segments: 1). management and franchise; 2). ownership; and 3). timeshare. As we noted above, HLT has increasingly been focused on growing its franchise business as this segment generates higher margins and provides long-term recurring cash flow. At the moment, its management & franchise segment consists of 3,883 hotels, resorts, and timeshares and has grown by 40% since June 30, 2007 in terms of number of rooms added. That’s good for 98% of its overall room growth over this time period.

HLT’s ownership segment consists of 156 hotels with 62,251 rooms that it owns or leases and its timeshare segment comprises 41 properties which are offered through a timeshare club with consumer financing provided.

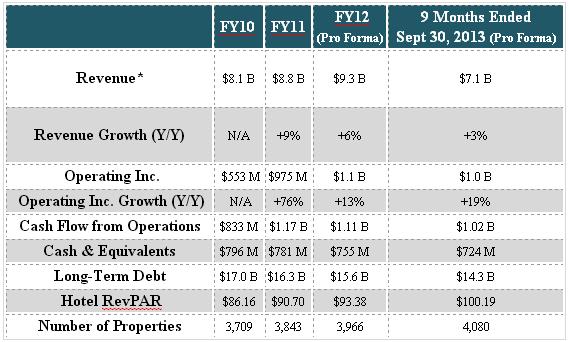

THE FINANCIALS

With modest mid-single digit revenue growth, HLT isn’t going to be overly appealing to most growth-oriented investors. However, for those that gravitate towards well-established, high cash-flow generating companies with reasonable valuations, HLT will look much more attractive. It does have a mountain of debt due to the 2007 LBO from Blackstone Group, but this fact alone shouldn’t deter too many prospective buyers.

Looking at its results for the nine months ended September 30, revenue inched higher by 3% to $7.1 billion. Not surprisingly, the biggest contributor to its growth was its Management & Franchise segment, up 7.9% year/year to $868 million. The company says that despite challenges in specific markets (Europe), it was able to increase rates in markets where demand outpaced supply. For instance, its Asia Pacific region had a RevPAR increase of 6.3%, and the Americas region saw a 5.4% increase.

HLT kept a very tight lid on its expenses as total expenses were essentially flat year/year. This control on costs goes hand-in-hand with its decision to focus on its franchise segment. The expenses attributed to its owned and leased hotels were down 3% year/year. This helped its operating income increase by 19% to $1.0 billion, and also lifted its operating margin to 14% from 12.1% a year earlier.

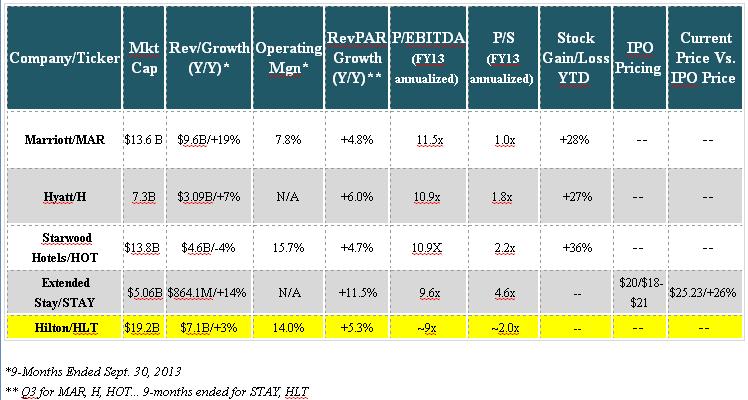

HOW HLT STACKS UP

Working in HLT’s favor is the solid performance from hotel stocks this year, which have slightly outperformed the S&P 500. STAY’s recent IPO can also be characterized as a success, as its currently trading 26% above its IPO price.

On the downside, HLT’s revenue growth is on the low side with MAR and STAY clearly outpacing the group. In terms of valuation, HLT is roughly inline with the rest of the group, with a bias towards being undervalued due to its low P/EBITDA and its potential for solid earnings growth going forward.

CONCLUSION

For investors looking for a well-established, prominent company that generates significant cash flow, HLT fits the bill. Its topline growth isn’t overly exciting, but, as it continues to expand its franchise business – particularly in overseas markets like China – revenue growth could pick up.

It’s not a perfectly clean story, however. Due to the LBO in 2007, it is saddled with a ton of debt. HLT also runs the risk of tarnishing its strong brand name by franchising out most of its properties.

All in all, though, this is a high quality company and institutional demand should be strong. With a reasonable valuation, HLT looks like a solid longer-term investment opportunity as a play on the recovering hotel industry.