“Will the markets close up or down today? Should I take profits? Cut my losses? Get short? Add to my position?” The accuracy by which a trader can predict today’s closing price will ultimately determine the size of his profits (or losses). The Wall Street ‘Pros’ take action before the market moves against them. Like sheep led to the slaughter, the Main Street ‘Joes’ often wait and pray – costing them hundreds or thousands of dollars in potential profits.

How do the Pros know? They don’t. But they do know the historically-based probabilities for any given day and market scenario. The Joes however take their cues from the myriad of pundits on financial news stations or online (where any ‘Joe’ can pose as a ‘Pro’) or via their ability to “read” the charts.

So how can today’s retail trader gain the same data-driven advantages as Wall Street? The answer lies in weather forecasting. Today, modern weather forecasting is based on using an “ensemble” of many differing models to create the most likely future weather scenarios. The key concept here is that evaluating a set of conditions from many different angles is superior to trusting a single analysis.

This basic premise of ensemble forecasting can be applied to financial forecasting and this approach has served me well over the past 10 years of active investing and trading. Fortunately, the same level of sophistication and granularity of national weather forecasting is not needed in order to benefit from its power. Simply evaluating a given setup by three or more unrelated or lowly-correlated analytical methods can greatly increase the accuracy and usefulness of back-testing financial markets.

To anticipate the most likely closing direction of a market (i.e. stock, future or commodity) for a given day, I first determine the size and direction of the opening gap. Then I evaluate historically similar gap openings in the context of current Momentum, Volatility, Overbought/Oversold, Trend, and Seasonality pressures. My analysis is based on research I’ve created over the years while trading the opening gap, as well as innovative, industry-leading technical approaches developed by other industry technicians such John Bollinger and Welles Wilder.

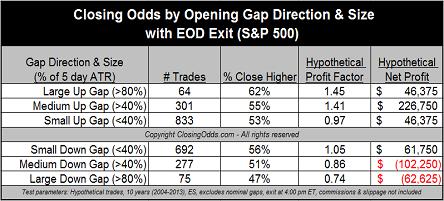

Since 2003, 54% (1,206 / 2,242) of opening gaps of at least 1 point in size (ES, or ~10 cents in the SPY) have closed HIGHER than their open by the end of the day. Though showing a slight bullish bias, this bias can be amplified or reversed when considering the gap size and direction. Figure 1 shows the significant edge gap size and direction provide into the odds of the S&P 500 closing higher on a given day.

Figure 1: S&P 500 closing odds based on opening gap size and direction (10 ES contracts).

Gap size is based on fixed percentages of the 5 day Average True Range (ATR). The True Range is the greater of the difference between: a) the high and low of a session, or b) the difference between the prior close and the high or low of a session.

Profit Factor (PF) is a term which represents the ratio of historical, simulated profits and losses. If PF is > 1 then that scenario has made more money than it lost during the back-tested period, the bigger the better of course. For example, a PF of 2 means that twice as many profits were generated than losses.

This opening gap technique can be further enhanced by considering the current Momentum, Volatility, Overbought/Oversold, Trend, and Seasonality conditions. Whether you want to day trade the action or just optimize your swing trade entries and exits, knowing the closing odds can help you and using the opening gap size and direction is a great place to start.

= = =

Join Scott Andrews, a former public company CEO and founder of www.ClosingOdds.com, as he shares his own personal research on this crucial topic on Thursday, December 19. Andrews will show you a simple way to identify when a closing bias exists and explain the 5 factors he considers every day. He will also share a free link for accessing his daily research. Register here for this eye-opening presentation!

Join the conversation on our Facebook page. We’d love to hear from you.

RELATED READING

Read another story by this author