Besides Brazil, we don’t hear much about South American countries when discussing international equities. However, today I want to take a look at one southern South America country – Chile; and a few bullish signs that could help take price higher.

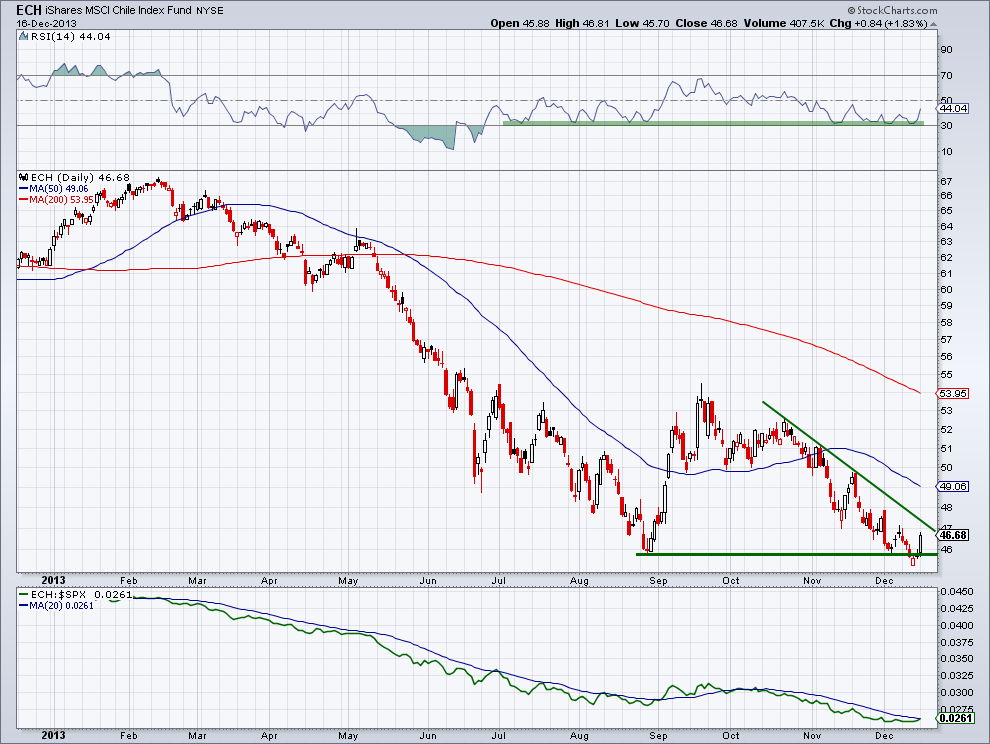

When I review international markets I often start by looking at their relative performance to U.S. stocks. As we can see in the bottom panel of the chart the iShares Chile ETF ($ECH) has underperformed the S&P 500 for the roughly the last two years with a more pronounced drop in the second and third quarters of this year. I use the 20-day moving average with the ratio of ECH and the S&P 500 to get a better idea of the trend in relative strength. Right now we are seeing the ratio between the two markets test the moving average and we’ll see if Chile can break to the upside and starting leading U.S. equities.

Looking at the latest price action in ECH we can see a false break of the previous low. I’ve drawn a green trend line off the August low, and as you can see on the chart, we broke under it for one day last week. However, the next day and with more strength on Monday, saw price show break back above that low as buyers stepped up in force. If bulls continue to control the price action in ECH I’ll be watching to see if we can break the trend of lower highs and get above the falling trend line that’s right around $47.

Another positive sign for Chilean stocks is the Relative Strength Index (RSI), which is on the top panel of the chart. Typically when bears are in control of a market we see the RSI indicator break below the ‘oversold’ level of 30 repeatedly. We can see an example of this in May and June as ECH headed lower. But notice what’s been happening in the RSI over the last 5 months. While ECH has been under selling pressure, the momentum indicator has held above ‘oversold’ status without a single move under 30. If we see a break of the falling trend line I mentioned earlier we can watch for confirmation in momentum for a break above 50, which has acted as resistance for the last month.

It’s important to remember that these three bullish signs for Chilean equities are still in their infancy. While these are good signs for those bullish on ECH, I’ll be watching the priceaction over the next week to see if things can continue to improve and show signs of a potential trend change.

Disclaimer: The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.

= = =

Show your love for TraderPlanet. Like us on Facebook