One of the most talked about currencies of 2013 has been the Yen. The Japanese government is still adamant about weakening their currency, so their export sector can recover and thrive again. The government intervention has caused some epic trends this year for the Yen pairs, and has given us Forex traders plenty of opportunity to capitalize on it.

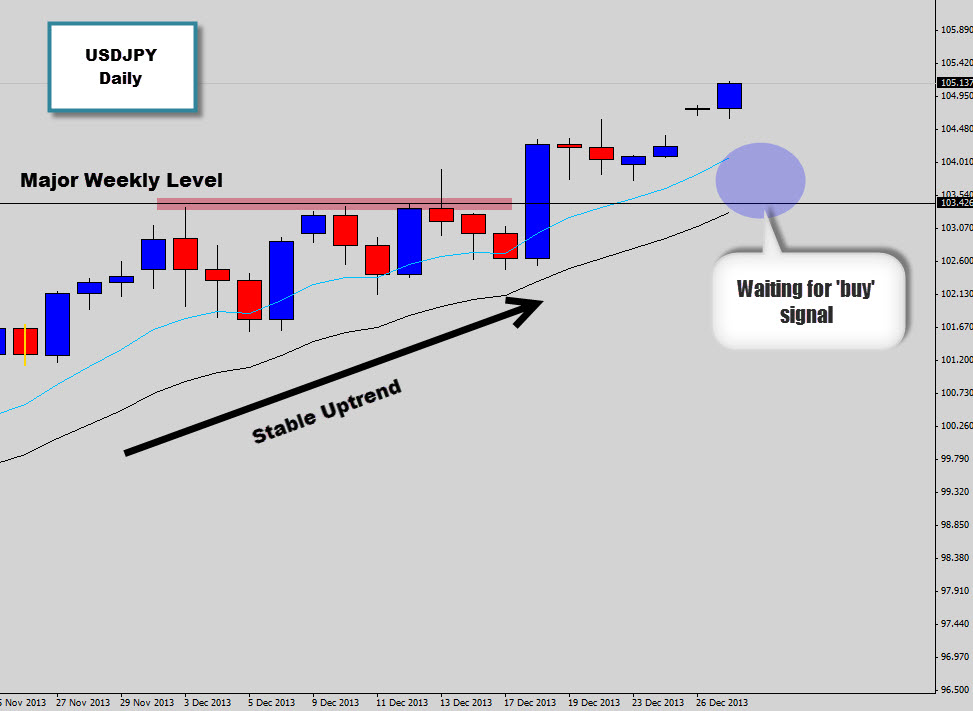

Not even the Christmas-New Year break has slowed down the dollar/yen (USD/JPY) movement. Toward the end of December 2013, we seen a key weekly resistance level of 103.42 violated as the upward trend pressure caused price to breach this containment line, and start pushing into fresh highs.

Our focus here is to try position in long with this trend movement, but instead of just impulsively buying into the market, we need to be a bit savvier and wait for a better buying opportunity. Generally with up trending markets, it’s best to buy during times of weakness like after a counter trend retracement.

We are waiting for the USD/JPY daily chart to correct and retest the key weekly resistance level that was just breached, and see if it holds as new support. This will be a nice ‘hot spot’ for a bullish price action signal to form, and be an excellent price to enter into the trend.