On January 7, Micron Technology (MU) reported better than expected Q1 adjusted EPS of $0.77 and revenue of $4.04B. This helped send shares of the semiconductor company to levels not seen since 2002. Despite the multi-year highs, Micron Technology trades at a P/E of 11.05x 2014 earnings and 9.24x 2015 earnings. Notable hedge fund manager David Einhorn recently took a position in the stock according to recent filings.

Options Activity

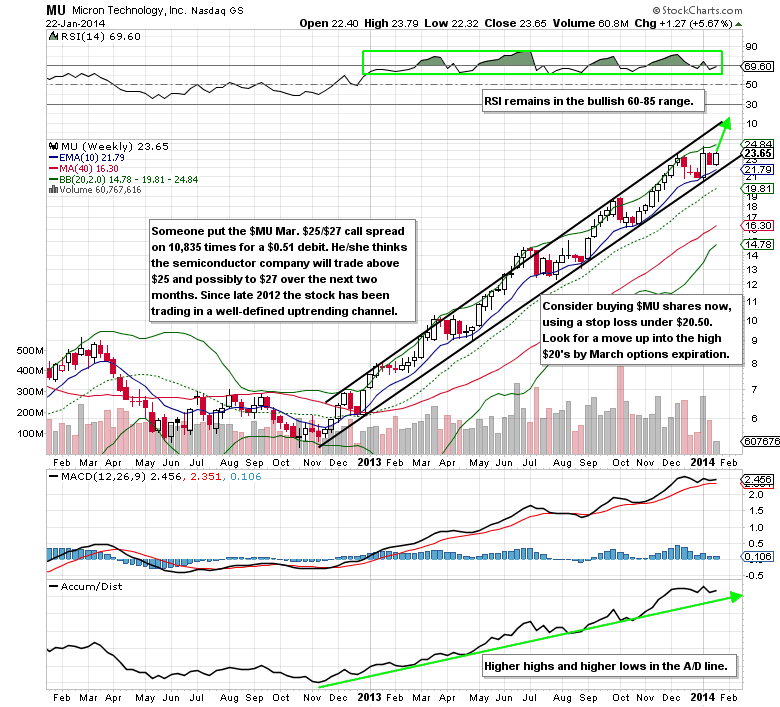

On Wednesday, January 22nd, someone put the March 2014 $25/$27 call spread on 10,835 times for a $0.51 debit ($552K). He/she is making a bullish bet that the stock will rise above $25 and possibly trade up to $27 by March options expiration. The maximum gain on this trade is $1.49 (292%). The call to put ratio finished the day at 4.41 with net call premium of +$1M vs. net put premium of +$50K.

Technical Analysis

Shares of Micron Technology have been trading in a well-defined uptrending channel since November of 2012. The stock successfully tested the bottom of the channel in early January and is now setting up for a move to the high $20’s.

Micron Technology Options Trade Idea

Buy the Mar 2014 $25/$27 call spread for a $0.57 debit or better

(Buy the Mar 2014 $25 call and sell the Mar 2014 $27 call, all in one trade)

Stop loss- None

1st upside target- $1.20

2nd upside target- $1.80