As many of you know, I do love technical analysis and candlestick trading. I rarely get asked the question “what is your favorite candle stick pattern” but it seems like a valid question to answer.

Before I answer it though, let me give you a list of a few of my other favorites. My favorite hand in poker is Ace, Nine of hearts; my favorite car, Lamborghini Diablo; my favorite color, Red and my favorite movie, “Liar Liar”.

Ok, it’s knowledge time. In regards to trading, candlesticks will give you the earliest entries, the best entries and the best insight into market sentiment. However, many times in trading, you need a lot of confirmation, multiple candle patterns, a strong chart pattern and a great support/resistance line before one can go bullish or bearish. A very strong candle pattern and one of my favorites, if not my favorite candle pattern, is called the one white solider.

The one white solider isn’t the most “commonly” known pattern. Many have heard of the three white soldiers. That’s all well and good but at this point you are likely asking, how do you use this to help your trading? You will rarely find the definition of a one white solider candle pattern in combination with how to trade it. Well, here it is.

In a one white solider candlestick pattern you must have two things. First is a black candle; second is a white candle. The preceding trend, or move, should also be bearish. The white candle must open and close above the prior black candles open and close, therefore, creating a little gap intra-day. The reason it’s a pretty powerful candle is because it “traps” anyone short in the prior day’s black candle. They pull up their computers and see not only is the stock up but more or less soared past their stop in a bearish position. So, they are forced to buy to close.

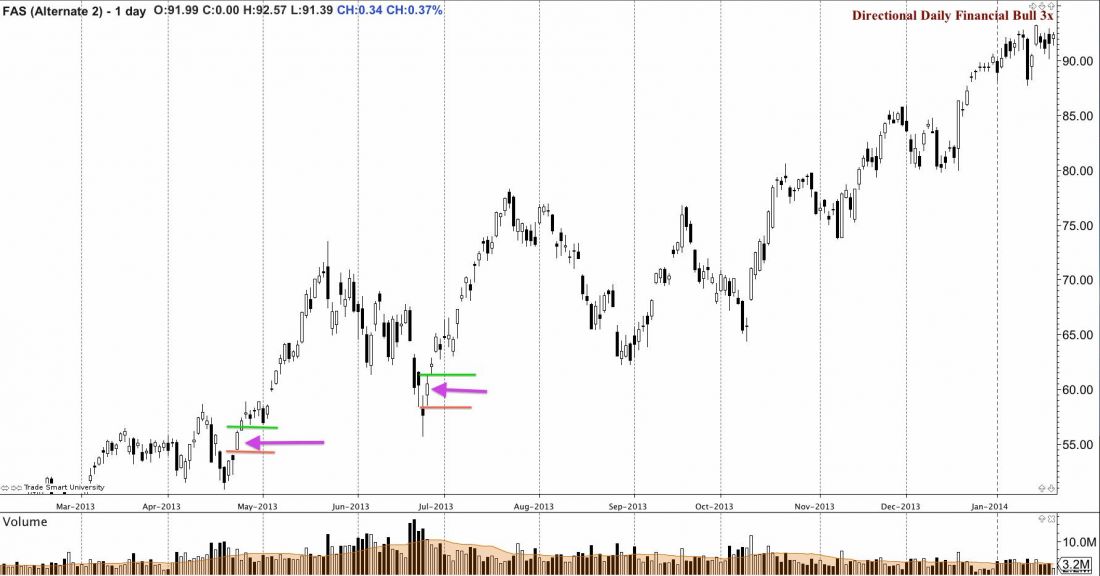

The image below is of FAS. I love this ETF. It’s volatile, pays great premiums for covered calls and put sales and is quite disciplined. The purple arrows point to the one white solider candlestick pattern.

The trade set up? – REALLY simple actually. If the stock/ETF or whatever you are trading makes a higher high the next day, get in. Place the stop below the low of the solider candle pattern and off you go! Many texts books require this candle pattern to be at a very strong support. It’s definitely an added bonus if this is the case. So, if the trade goes bullish, pick your bullish strategy and go let the market pay you for being an awesome person!

Remember, trading the market is easy. Don’t stress about it, continue learning and adapting, and reach out because I’m here to help!