Today we turn our eyes to Europe and we see another one of its countries presenting a good investment opportunity.

For a few years, and especially during the European crisis, Spain was under the gun for all the mess it had created inside its financial and real estate market. Along with that the country had a very high unemployment rate.

MARKETS LIKE REFORMS

Here we can see how Spain is a perfect example of how the countries that implement the appropriate reforms on time are liked by the markets. The new government has worked hard on many angles and after almost two years, we are seeing some positive results.

The economy of this state expanded 0.3% in the fourth quarter. The government estimates that the economy will grow at least 0.7% this year.

RELATED ETF

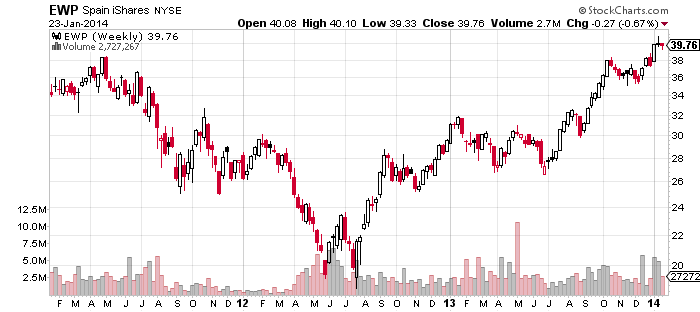

This hard work has had a good result in its stock market as well, pushing the iShares MSCI Spain ETF (EWP) up almost 30% over the past year (2013) and 3.5% so far this year (2014).

EWP has a heavy allocation towards the financial sector at almost 50%, followed by industrials and telecom services, which combined add up to 25%. The top two holdings are the very well-known Banco Santander and BBVA, which make up 32% over the overall portfolio.

The fund has outperformed the broader Vanguard FTSE Europe ETF (VGK), which is up 0.5% so far this year (2014) and increased 22.0% over the past year (2013).

BOTTOM LINE

Many investors are feeling more confident investing in Spanish assets and related exchange traded funds and are looking for the most appropriate moment to hop on board this train. The time may have come already

Today, the IBEX 35 is slipping below the 10.000 point level, which means that EWP will also experiment a retracement in its share price, granting us a good pullback to enter this market.