CareFusion, the global medical technology company, is expected to grow EPS by 12.8% and revenue by 4.3% in 2014. On January 29, they announced an eight year agreement with Terumo, the largest medical technology company in Japan, to sell Terumo’s SurFlash line of peripheral IV catheters in the U.S. CareFusion is set to announce Q4 earnings after the bell on Monday, February 3.

Options Activity

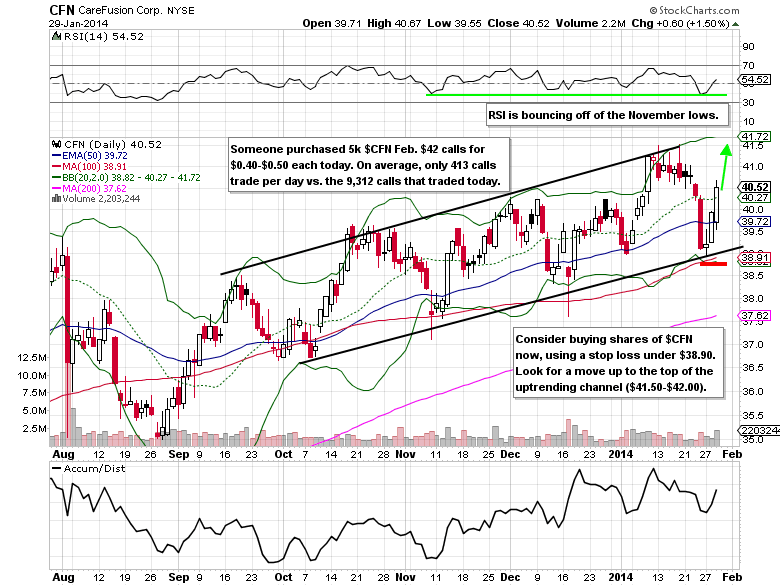

5,000 Feb. 2014 $42 calls were purchased for $0.40-$0.50 each, following the exclusive agreement with Terumo. The Feb. 2014 and Mar. 2014 $41 calls were under accumulation as well. On average, only 413 calls trade per day. This sent implied volatility up nearly 20% to 32.15.

The Technical Take

Shares of CareFusion have been trading in a well-defined uptrending channel since September. Despite the weakness in the S&P 500 (SPX) and the Health Care Select Sector SPDR ETF (XLV) this week, CareFusion shares put in a higher low at the bottom of the channel and are now setting up for a run at new all-time highs.

CareFusion Options Trade Idea

Buy the Feb 2014 $41 call for $1.20 or better

Stop loss- None

Upside target- $2.00-$2.50

Disclosure: I’m currently long the Feb 2014 $41 calls for $0.91 each.

= = =

Learn more: