Thursday we saw how Facebook (FB) shares jumped close to 15% after the company revealed a 63% increase in revenue and an incredible increase in profits over the 4Q of 2013, exceeding all expectations.

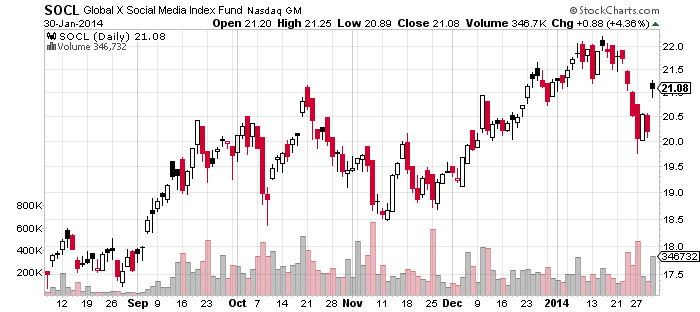

This boost in FB also pushed the price of Global X Social Media Index ETF (SOCL) up over 4% Thursday opening a bullish gap on the daily chart.

FURTHER PUSH

This ETF is looking to continue profiting from the upcoming earnings data from many of its holdings that will be released in the next few weeks, such as Pandora Media (P), Twitter (TWTR), Yelp (YELP), Zynga (ZNGA) and LinkedIn (LNKD).

The retracement might be over for this exchange traded product, and all we have to do is follow its movements to time our entry.

ETF PLAY

One of the strategies many investors might use is to trade the gap, and place a buy order between $20.57 and $20.89.

The other and simpler way of trading this ETF is to just buy SOCL before the next one of the holding companies presents its earnings, which will be on February 5 of 2014.

BOTTOM LINE

In the past, most publicity expenses were pointed towards advertisements in newspapers, magazines, television, etc. In today’s world, most of the publicity expense is pointed directly at the internet and especially towards mobile systems. SOCL is a clear instrument to profit from this change of mentality.

===