Shares of the investment firm, American Capital (ACAS), trade at a PEG ratio of 0.48x 2014 estimates. They are expected to grow revenue by 4.7% this year. Last year, American Capital invested over $325 million into 18 new and existing portfolio companies and cashed in over $1.2 billion from prior investments. They expect another strong year in 2014 as the company plans on using the recent proceeds to invest into new companies throughout the year.

Bullish Options Activity

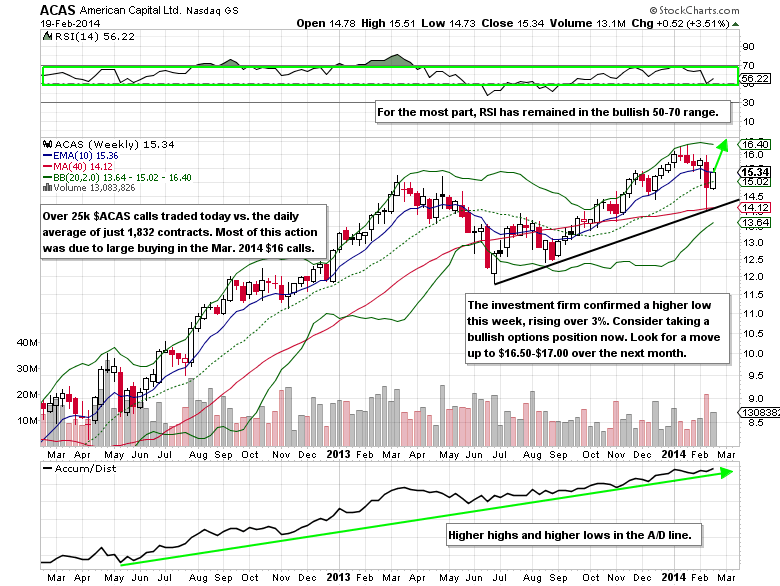

On Wednesday, February 19th, over 25k calls traded vs. the average daily volume of just 1,832 contracts (13x the average). Most of this activity was due to large buying in the Mar 2014 $16 calls. Implied volatility rose nearly 30% to 31.82. On Friday, February 7th, there was also bullish activity, but it was a buyer of 6k+ Mar 2014 $17 calls for $0.13-$0.21 each.

Technical Analysis

The upside call buying in the Mar 2014 $16 calls led to a nearly 2% gain on over 4x the average daily stock volume. On the weekly chart, the stock put in a higher low at the eight month support level. At a minimum look for follow through to the $16.50-$17.00 area over the next month.

American Capital Options Trade Idea

Buy the Mar 2014 $16 call for $0.33 or better

Stop loss- None

1st upside target- $0.50

2nd upside target- $1.00

Note: I’m long the (ACAS) Mar $16 calls for $0.21 each.

= = =