Last night, Facebook announced a $19 billion acquisition for What’sApp the mobile messaging service. An aggressive move from the young CEO. What’sApp has 450 million users paying $1 annually for basically a free and disruptive service to the major carriers. The stock should see a little pressure for the first couple of days as it’s not a very accretive deal. ChartLabPro went to a Strong Buy (5rating) at $53.32 and is still looking strong with only an approaching overbought level.

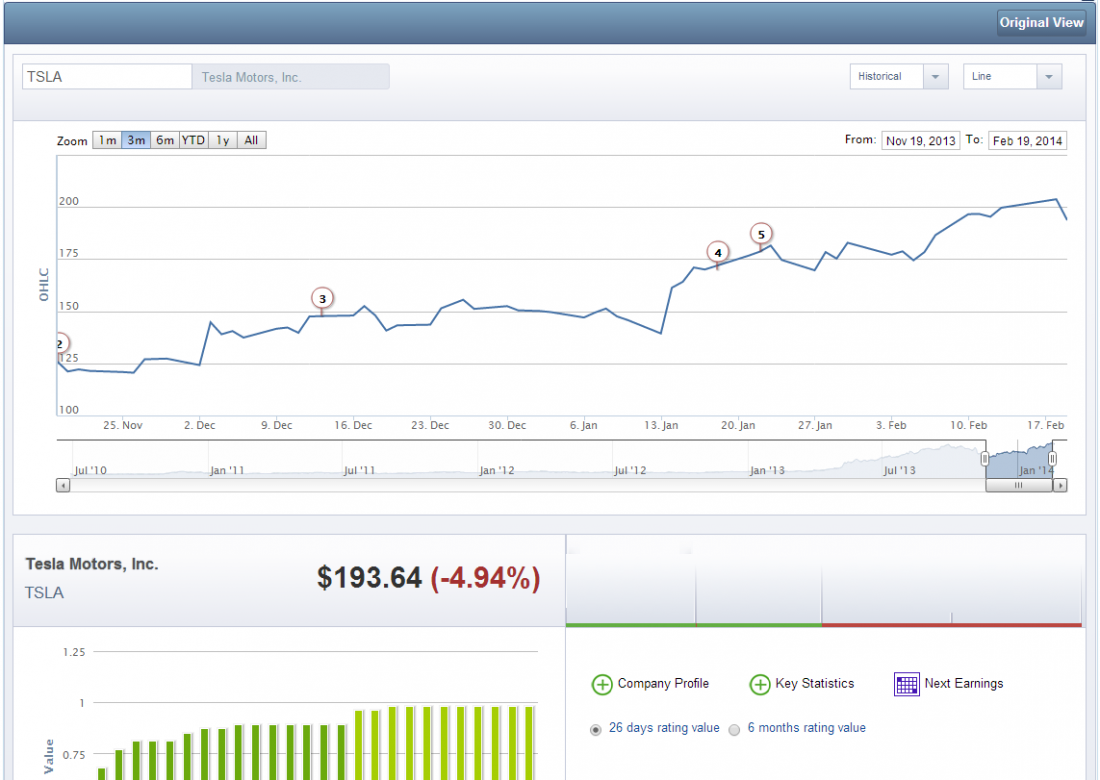

Next you have Elon Musk who delivered as promised on his 25% margins after Tesla released earnings. Additionally, the company exceeded production of 35,000 units from the streets expectation of 32,000. Most importantly, was the comment about the company seeing 28% margins late 2014. This will help give the stock price and earnings momentum. You can’t invest in a name like this based on current fundamentals, it’s all growth expectations. The company has a $23 billion market cap with Price to Sales of 14.65 and a PEG Ratio of 12.29 vs. a traditional company like Ford with a $60 billion market cap, Price to Sales of only .41 and a PEG of only .99. ChartLabPro went to a Strong Buy (5 Rating) at $178.56. The stock is trading up 12% premarket to $216.86 after their earnings release. If the company can deliver on their margin expansion and additional growth in China, this stock has more legs to run.

= = =

For more information about ChartLabPro visit us at www.chartlabpro.com