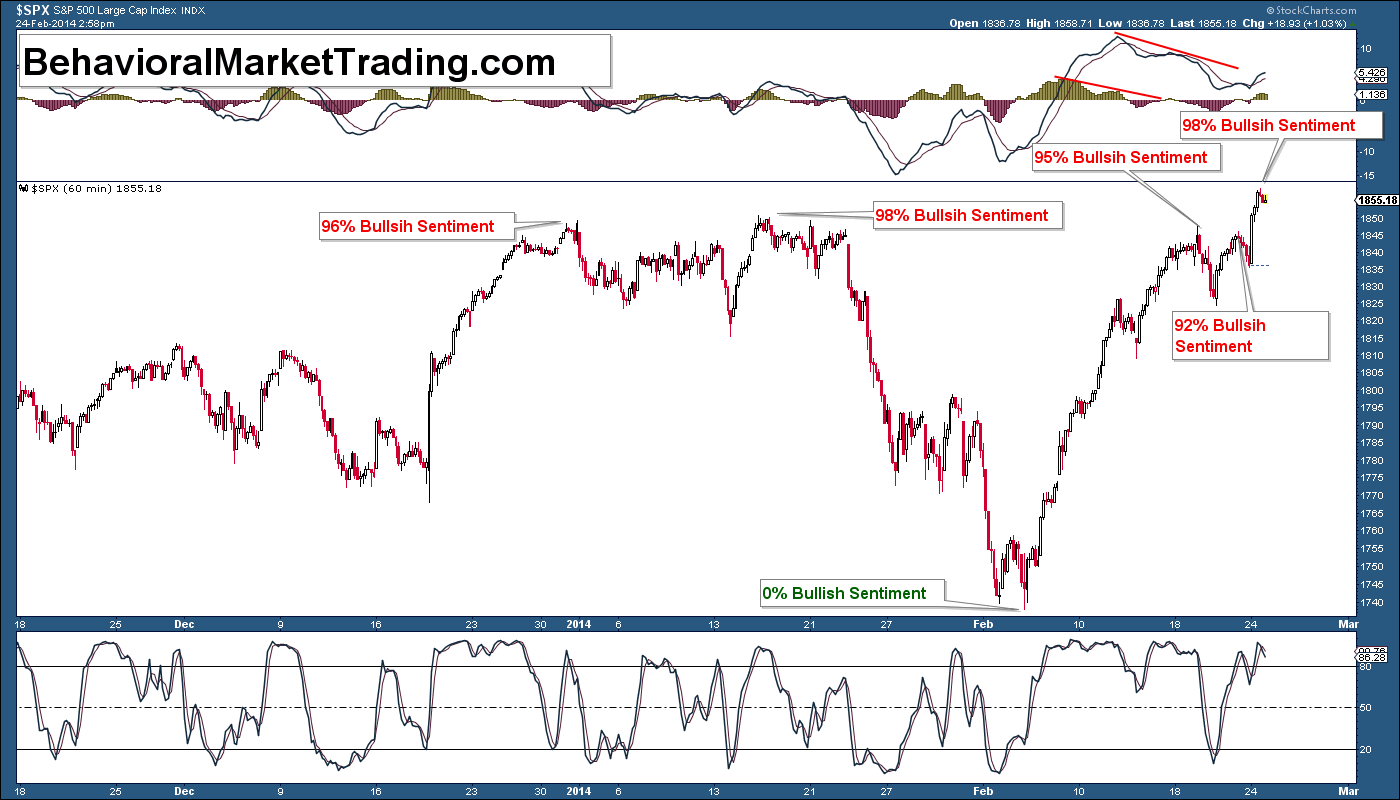

Two weeks ago, I mentioned the lows were in, based off of the extreme bearish reading we got on February 4th. I was expecting a retrace up to the 62%-78% resistance levels, before starting lower again. Our sentiment timing profile allowed for a multi week bounce off the lows, but price was not determined and the resistance levels were potential targets.

As I type, the S&P 500 (SPX) is at new all-time highs and the upside targets have been blown through. This is the “new normal” all in or all out with no time to think about your next move and why TIME is more important than price.

You have to anticipate the markets next move, almost like a poker player. If you try and think, the SPX will be 40-50 points higher or lower before you even have time to react.

Sentiment cycles repeat over and over again. The three things you have to follow at all times to stay one step ahead of the next move:

1.) Sentiment: How do traders feel about the market-are they overly bullish or bearish

2.) Time: When is the next turn date scheduled? I mentioned sentiment cycles repeat over and over. They typically run in similar time periods for the recycling process to start and end. Knowing when they are scheduled to change is a must!

3.) Price: Where are resistance/support levels? If above below, wait for a short or buy set up.

Knowing how traders feel and when the sentiment cycles are set to recycle are the more important of the three trade factors. Once you know that, simply look for where price could reverse and wait for conformation.

= = =

To see when the next Sentiment Cycle is scheduled to recycle, click here