We’ve recently read how Facebook (FB) has made the largest acquisition within the tech stocks industry in recent years by purchasing WhatsApp for $19 billion.

So far the biggest deal was made by Google (GOOG) when it purchased Motorola Mobility for $12.5 billion, followed by Microsoft (MSFT) when it picked up Skype for $8.5 billion.

[Editor’s note: Read Amar Daryanani’s previous story on SOCL on Traderplanet. ]

ETF KEEPS CLIMIBING

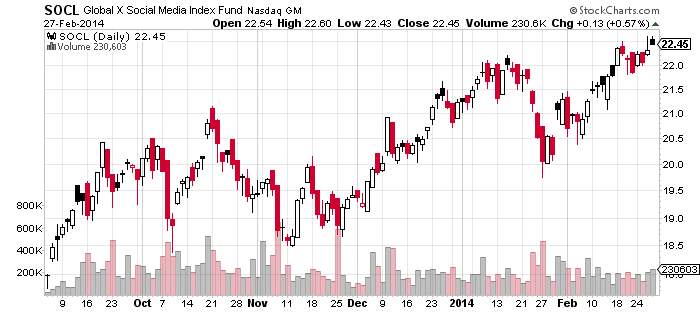

One of the most relevant ETFs to Facebook is Global X Social Media Index ETF (SOCL). This ETF is currently breaking all-time highs with a close on Thursday at $22.45. The price keeps climbing and is lifting support levels each time higher.

Another reason why SOCL is rising is due to the announcement that King Digital Entertainment will file for an initial public offering. This company is a developer of popular Facebook and smartphone games, such as Candy Crush Saga, Pet Rescue Saga and Farm Heroes Saga.

SOCL already has under its umbrella Zynga (ZNGA), which is widely known for Facebook games such as Farmville.

ON THE LOOKOUT FOR A NEW MEMBER

It’s quite obvious that SOCL will most likely want to include King Digital Entertainment in its holdings once the company goes public. And the mere expectation that this could happen will most probably drive fresh funds into SOCL before the IPO. The same way it did with Twitter (TWTR).

SOCL looks like it’s heading towards the $25 mark, probably before the end of the 2014 summer.