The equity markets are looking like the miracle of the loaves and fishes these days. Every crumb of news – good news, bad news, not-quite-true news – is driving the markets higher.

The multitudes are being fed with not much more than hot air, and the continued suspension of disbelief is nothing short of miraculous.

A recent headline on the cranky perma-bear website Zero Hedge seemed to sum it all up nicely “Stocks Close At New Record High On Russian Invasion, GDP Decline And Pending Home Sales Miss.”

And that new high was followed by another all-time high Friday, when the futures contract (ESH4) touched 1887.50 and – as usual on days when employment data is released – closed green.

But the bull market, which will celebrate its fifth birthday this week, is starting to look thin. There is good evidence it is now substantially overbought:

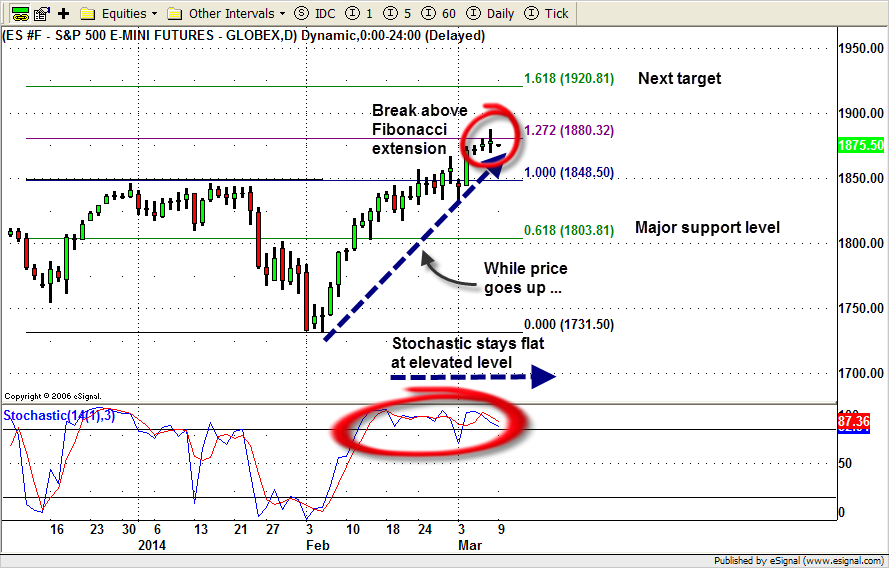

• Technical indicators (MACD and stochastics) are in extremely overbought territory and have been for a long time (see weekly chart). MACD in particular is showing a negative divergence with the price

• The futures just reached an important Fibonacci extension level when they broke above 1880. A retracement of some kind is all but inevitable.

• The rally has been running wild for months, up 65 points in just 12 trading days, about 500 points in 12 months, about 1220 points since the bull came to life from the low on March 13, 2009 – and with no significant retracement past the first Fibonacci level in the past 60 months.

Nothing goes up forever, and markets that are wafted aloft on not much more than feel-good sentiment can quickly reverse when sentiment changes.

At this point, a harsh word in the right place could smash the market down 100 points in a couple of days.

So with all this angst, we must be bearish, right?

Nope. There isn’t much room left on the upside, but as long as the futures don’t break below 1790 we see the rally continuing.

Short-term, we’re expecting a pullback, of some kind and some duration. But we have support levels at 1849.00-46.50, 1834.50-35.50, and 1824.25-21.50 for this week. We expect to see buyers entering at those levels and attempting to push the price back up.

Longer-term, we think this rally could pause briefly at 1900, but could motor on up to 1920 before we get into the summer doldrums. Trades at 2050 or higher may be seen later in the year if the price can hold above 1790.

At these levels, we’re scared. But we’re still long.

Options on the index futures are a good way to trade movements in the broad equity markets. For more information about how to use them, go to this link: http://members.naturus.com/options/

S&P500 mini futures (ESH4) to Mar 7, 2014