This week features one of the more intriguing IPOs of 2014, in my opinion. The company, Castlight Health (CSLT), has developed a cloud-based software platform built to help corporations control rising health care costs. This is a problem that seven out of ten CFOs consider to be the most pressing one , according to CSLT.

It is a very early-stage company with limited revenue and significant losses. However, I believe that most investors will focus on its growth potential and the fact that it is a first mover in a market estimated to exceed $5.0 billion. The main issue facing its’ IPO is valuation, which will be off-the-charts.

CSLT will be offering 11.1 million shares within an expected range of $9-$11. The lead underwriters on the deal are Goldman Sachs & Morgan Stanley, a tandem that will also draw attention to this deal.

CSLT’s Healthcare Cloud Offering

CSLT’s core product offering is called “Enterprise Healthcare Cloud Offering.” Here is how it works. First, its technology aggregates massive amounts of data from the healthcare field including data from healthcare providers, insurance companies, governmental agencies, and quality-monitoring organizations.

Once the data is collected, its team of engineers, economists, and clinicians apply complex data science techniques to leverage its database to drive a number of important insights. These include identification of high-risk patients and estimated future costs of care.

Once this data has been collected and analyzed, CSLT can map personalized cost information by region and individual service providers for a broad range of healthcare and physician services and medical products. All of this information is then funneled through to its easy-to-use employee and employer interface.

The end result is that the employee is given a very transparent display of available healthcare options, comparing costs and quality of care. Similar to an advertising platform, the Enterprise Health platform shows optimal health care choices that users have been searching for recently. Additionally, employers have the option of offering incentives for choosing more cost-effective healthcare options.

Customers And Revenue Generation

CSLT’s client base is relatively small at this point, but it is growing rapidly and it does include some very large companies. As of December 31, 2013, it had 106 signed customers. A few of the more prominent names include the Administrative Committee of the Wal-Mart Stores (16% of revenue), Carlson Inc., Cummins, and Safeway.

CSLT generates revenue from sales of subscriptions, support, and services primarily related to the implementation of its software.

Its subscription fees are based on the number of employees and adult dependents that employers identify as eligible under its offering, and its contracts with customers generally have a term of three years.

Financials And Valuation

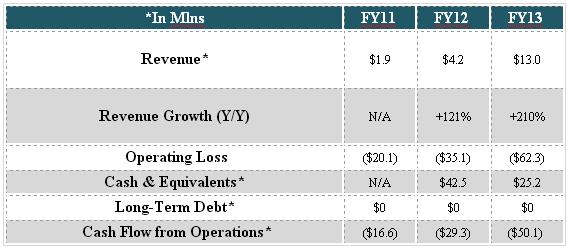

Currently, CSLT’s financials aren’t much to look at. Its revenue growth is strong, but, it is coming off a very small base. It is not profitable, which is not surprising for a company this early in its growth cycle, but its losses are widening considerably.

The results don’t look much better from a cash flow standpoint. For 2013, its operations burned ($50.1) million. With no debt on the books, its balance sheet looks to be in good shape, although its cash burn has taken a toll on its cash balance, which has dropped from $42.5 million in 2012 to $25.1 million in 2013.

While its weaker financials can somewhat be forgiven at this point, given the company is only 6 years old, the valuation on this deal is off-putting. At the mid-point of the proposed price range, it would have a market cap of $865.7 million. The company only did $13 million in revenue last year, translating to an off-the-charts trailing P/S of 66.6x.

For a high-growth company, investors will focus on a forward P/S, but, even if we assume 200% revenue growth for 2014, its P/S equates to an astronomical 22x.

Conclusion

This shapes up to be an exciting deal and one that should generate strong interest. It’s a company with a unique product that appears to effectively mitigate one of corporate America’s major hurdles — rising healthcare costs.

The market opportunity is large and with its head start on the field, it should have little trouble tapping into this estimated $5 billion addressable market.

There are clear negatives, though. Its financials are not strong as it is losing a lot of money and is rapidly burning through cash. Its valuation is also hard-to-swallow. Even if 2014 sales growth exceeds 200% again – which is possible considering its lofty backlog of $109 million — its P/S still would sit well north of 22x.

So, how will CSLT play out? My sense is that institutional demand will be strong, enabling it to price well. It could also see a nice pop when it opens for trading. But, once the dust settles and investors are left staring at a trailing P/S that could approach 100x, depending on where it opens, it’s easy to imagine that valuation will quickly become a major headwind for the stock.