Shares of General Motors (GM) have fallen 13.82% year to date largely due to weather related issues and more recently on an ignition switch problem cover up.

The Numbers

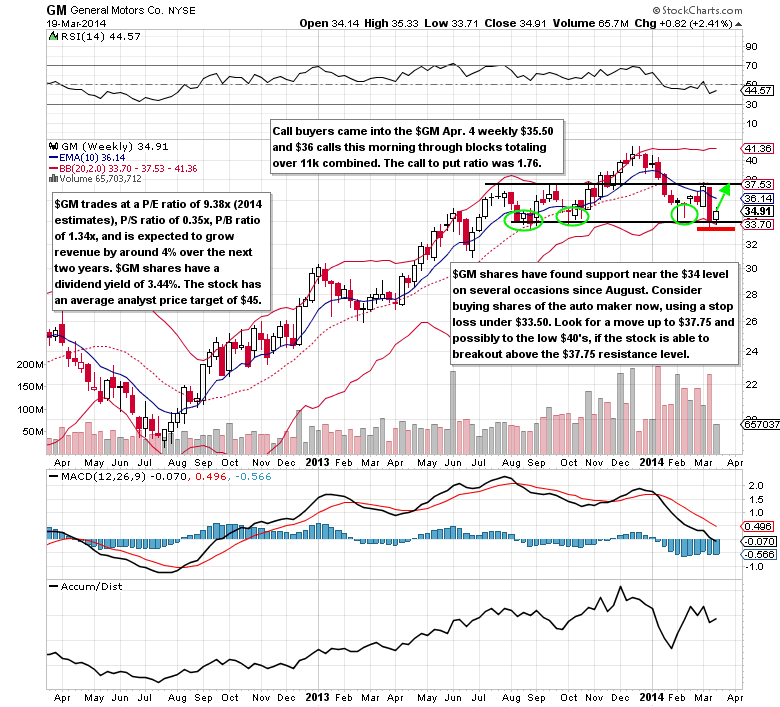

Due to the unfortunate start to 2014, GM now trades at a P/E ratio of 9.38x (2014 estimates), P/S ratio of 0.35x, P/B ratio of 1.34x, and is expected to grow revenue by around 4% over the next two years. The stock currently has an average analyst price target of $45. This compares to Ford’s (F) P/E ratio of 11.55x (2014 estimates), P/S ratio of 0.40x, P/B ratio of 2.25x, and is only expected to grow revenue by 0.50% this year. Ford has a current dividend yield of 3.23% vs. GM’s dividend yield of 3.44%.

Unusual Options Activity

On Wednesday, March 19, there was large buying in the April 4 weekly $35.50 and $36 calls. This action mainly consisted of a buyer of 4k Apr. 4 weekly $35.50 calls for $0.65 and 6,900 Apr. 4 weekly $36 calls for $0.44. On Tuesday, there was a buyer of 3k Apr. 4 weekly $36 calls for $0.46 each.

Technical Analysis

GM shares have found support at the $34 level several times since August 2013 and did once again this week. Look for a move up to $37.75 over the next few weeks and possibly a move up to the low $40’s over the next few months. The reward/risk is currently 2:1 for the bulls.

General Motors Options Trade Idea

Buy the Apr. 4 weekly $35.50 call for $0.70 or better

Stop loss- None

1st upside target- $1.40

2nd upside target- $2.00

Disclosure: I’m long the Apr. 4 weekly $35.50 calls for $0.67 each.

= = =

Mitchell’s Free Trade of the Day featuring ConocoPhillips (COP)