Another internet giant has decided to go public recently. The company that has recently filed plans for an IPO is Sina Weibo. Weibo is a Chinese microblogging website and is considered to be a hybrid of Twitter (TWTR) and Facebook (FB).

It is one of the most popular sites in China, and is used by more than 30% of internet users, with a market penetration similar to what Twitter has established in the United States. Weibo has over 100 million messages posted daily on its social network.

One of the main shareholders of this company is the very well-known Alibaba Group, which earlier this year filed for its own IPO as well.

ETF RELATED

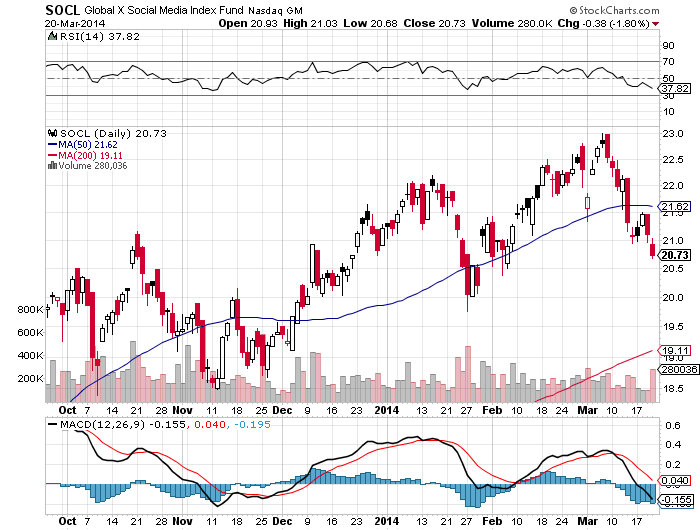

One of the ETFs that we like to track is the Global X Social Media Index ETF (SOCL). This exchange traded product allocates nearly 26% of its weight to China and has three Chinese companies in the fund’s top 10 holdings.

Some of us understand that once Weibo goes public, it wouldn’t be long before we see SOCL include the Chinese microblogging company in its portfolio.

TRADING IDEA

For those of us who are waiting for an opportunity to re-enter SOCL since its recent pullback, this could be a key moment to consider.

On the daily chart of SOCL we can see an initial support around the $20 level. With an RSI approaching the oversold area and a divergence in the MACD, the moment to go long SOCL again might come sooner than expected.