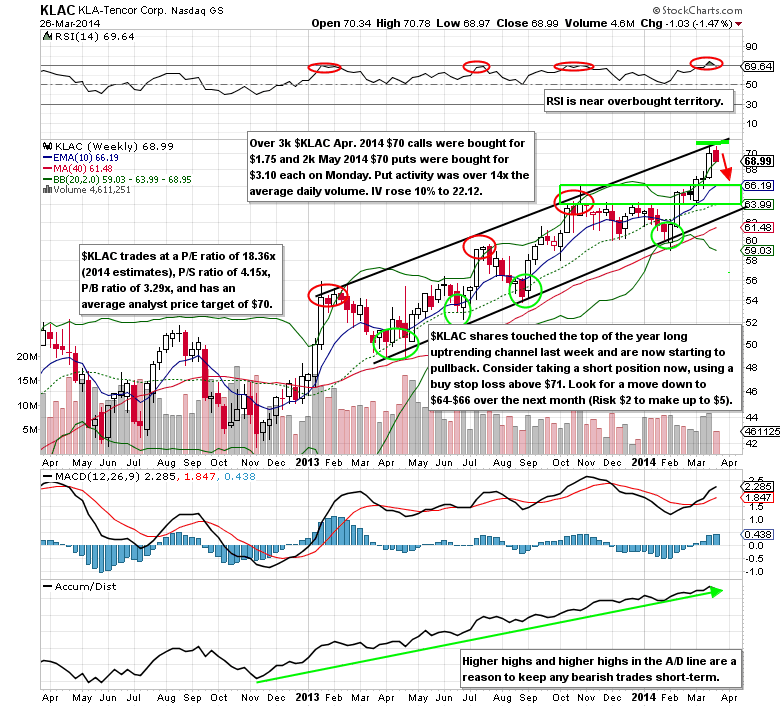

Shares of the semiconductor equipment company, KLA-Tencor (KLAC), have rose 16.89% since the start of February. During this time the P/E ratio has gone up to 18.36x (2014 estimates), P/S ratio of 4.15x, P/B ratio of 3.29x, and the stock briefly hit the average analyst price target of $70.

Bearish Technology Options Activity

On Monday, March 24, over 3,000 KLAC Apr 2014 $70 puts were bought for $1.75 and over 2,000 May 2014 $70 puts were bought for $3.10 each. Put activity was over 14 times the daily average volume. On the same day there was other big put buying in the parts of the tech sector. 4,500 Tableau Software (DATA) Apr 2014 $70 puts, 4k+ Splunk (SPLK) Apr 2014 $80 puts, and 41,500 Intel (INTC) Apr 2014 $26 puts were all purchased on Monday.

Technical Analysis

KLAC shares hit the top of the year-long uptrending channel this week and are now starting to run into selling pressure. The relative strength index (RSI) also moved above the 70 reading on the weekly chart, which has been a profit taking signal in the past. Look for a move back down to $64-$66 over the next month, using a buy stop loss above $71 to effectively manage risk. Given that this is a counter trend trade you have to keep a tight stop loss or use options as an alternative. This trade consists of risking $2 to make up to $5 (reward/risk ratio of 2.5:1).

KLA-Tencor Options Trade Idea

Buy the Apr 2014 $70 put for $2.00 or better

Stop loss- $0.85

1st upside target- $4.00

2nd upside target- $6.00

Disclosure: I’m long the Apr 2014 $70 puts for $1.70 each.

= = =