Goldman Sachs has been circulating a document repeating a question it is hearing more and more frequently from its clients these days: is the current market repeating the pattern that developed in March, 2000?

March of 2000, as everyone who was active in the market then remembers with some pain, was the month the tech bubble popped, and took the entire stock market down with it.

Then, as now, a handful of high-momentum stocks – an updated version of the `Nifty 50` of the last Millennium – were the darlings of the market. Hedge funds and institutional investors piled into them without restraint.

They had to, because these were the stocks that were moving, and if your fund didn’t buy them, your investors would move to a fund that did.

Then the bubble burst, and when the smoke cleared the S&P 500 was down 50% and the NASDAQ, home of most of the high-flying tech stocks that fuelled the bubble, was down 75%.

It took the S&P 500 seven years to recover to the point where it could squeeze out a nominal new high (it subsequently crashed again in the financial crisis of 2008). The NASDAQ has never fully recovered; it is still about 25% below the high it made 14 years ago.

IT IS HAPPENING AGAIN

History doesn’t repeat itself, but it rhymes, and the parallels to the current market are scary: a big rally concentrated in a few ‘momentum’ stocks, which then go right in the tank.

Over the last year the top 50 stocks in the S&P500 have had gains ranging from 65% to 189% for the 12 months to the end of February. The median for the entire S&P was 26%

And in March – just as in 2000 – those same stocks suffered losses that many market watchers described as “bloodshed:” Netflix (NFLX) down 24% for the month; Gilead Sciences (GILD) down 18% for the month; Alexion Pharmaceuticals (ALXN), after doubling in the previous 12 months, off 20% in March. Only one of the 50, Seagate Technology (STX), made any significant increase in March.

Those are the market leaders, the momentum stocks that powered the rally of 2013. If they can’t lead, who can? The ‘Nifty Fifty’ of 2013 probably won’t be pulling that train.

WHAT HAPPENS NEXT?

Goldman Sacks, ever the optimistic cheer-leader for the buy side, believes the worst has passed and estimates the S&P may be making new highs again by October.

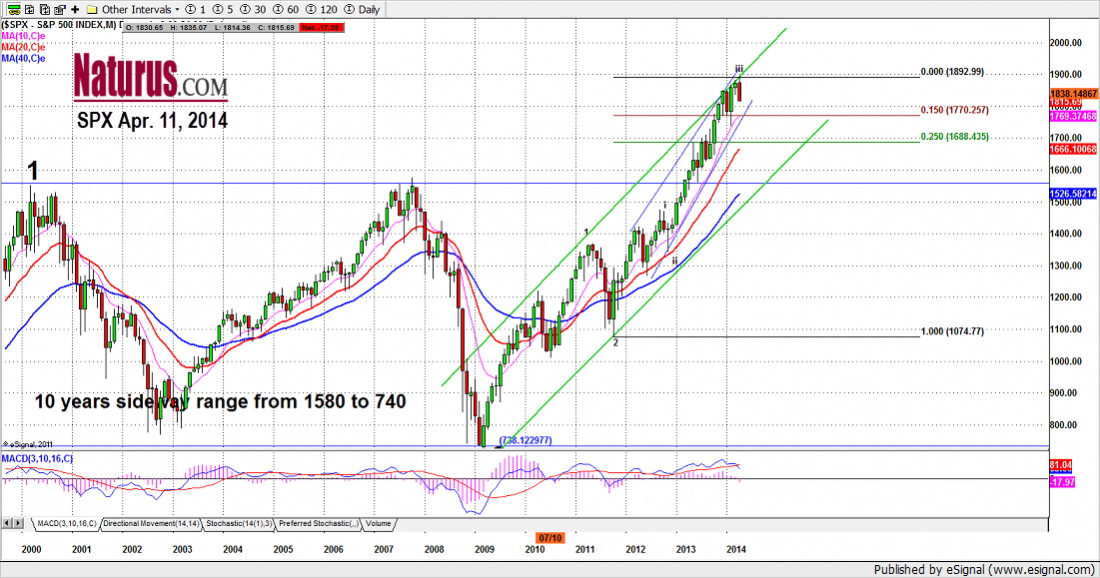

We don’t entirely disagree. The decline since April 1 has not changed the basic trend direction. The long-term bull market is still intact, and is likely to continue as long as the Federal Reserve keeps dumping money into the market. In the larger scheme of things, this is just a blip. (See chart).

But fear is replacing greed as the primary sentiment in the market, and we will probably see more declines. Our first downside target is 1740; and if we push past 1730, we could get down to 1601. But that will still qualify as a retracement, not a crash.

However, if Russia invades the Ukraine, all bets are off.

Clearly this isn’t a good time to take new long-term positions on the buy side. The choice is likely to be between going down a lot, or going down a lot more. You don’t want to stand in front of that train.

We are cautious optimists. But at this point we’re using short-term trading vehicles like the S&P 500 e-mini futures and short-term options, and we are making sure we know where all the fire escapes are.

Chart: S&P 500 Cash Index (SPX) Monthly