The theme this year has been one of reversion. Darling momentum stocks, many in the technology sector, have taken a massive write-down as leverage is reduced in those positions. Emerging markets and China have both seen strong rallies, and beaten down sectors such as coal and steel have (at least) stopped going lower. So while all those high-beta tech stocks now have plenty of bag holders, what kind of areas can we look to for relative strength?

RAIL STOCKS

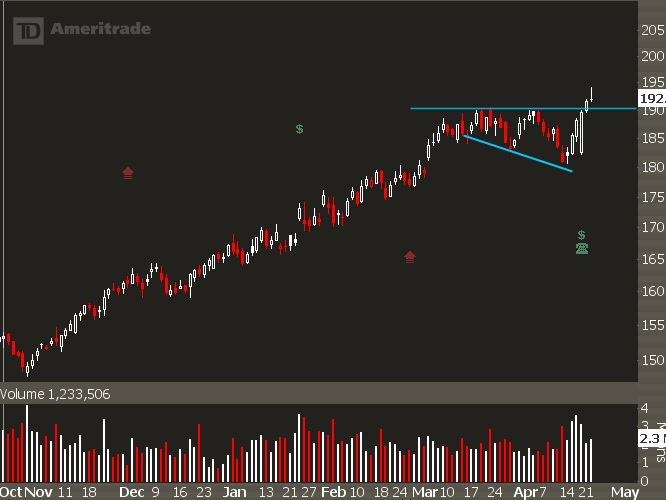

Late-cycle areas such as energy and utilities have been doing well, and one area to watch in the next month is rail stocks. On a fundamental basis, these names tend to do well when there is demand for their services — and if commodity prices and volume continue to rise, the demand will rise as well. UNP just broke out of a broadening triangle formation, and is now a clear market leader.

The stock is a little extended from the recent rally but watch this name for a pullback opportunity in the 190-187.50 area. NSC is completing a base on base pattern with a key level of resistance at 98.

This level will most likely hold the first time around but if it completes a higher low and breaks out, it’s a quick move to 100. This stock reports the morning that this article comes out so price volatility could change the pattern.

FOLLOW THE MARKET

The new leadership that we’re seeing isn’t very “exciting” and could in fact be signaling a waning bull market. But if the trend is there, you must let the market dictate the trade, not the other way around.