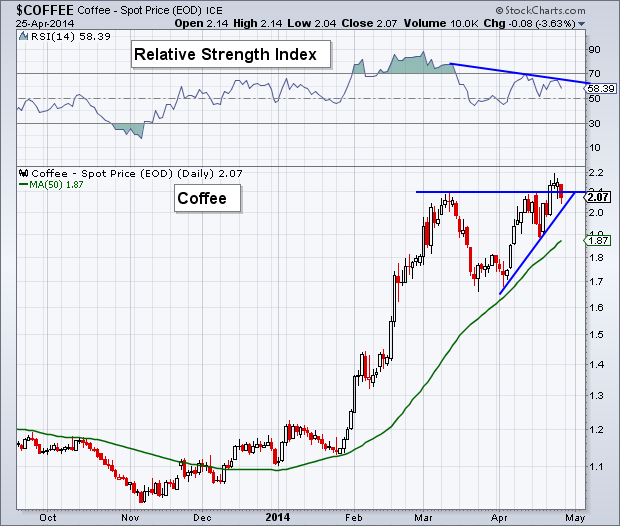

Coffee has been a power house so far this year. I came into this year one of the few bulls for the agriculture space but as all things — once they go up they must come back down. One of the best ag commodities this year has been coffee, up 87%. Since it’s one of the leaders I’m watching it for early signs of deterioration in its trend. Last week we saw coffee (KC_F) prices break above their March high but to only give those gains partially back on Friday as it fell back under the previous high. This took place with the Relative Strength Index creating a negative divergence of lower highs. Although, price is still in its uptrend off the previous April lows. If we see a break of $2.00 and the RSI breaks under 50 then we may begin to start seeking lower prices.

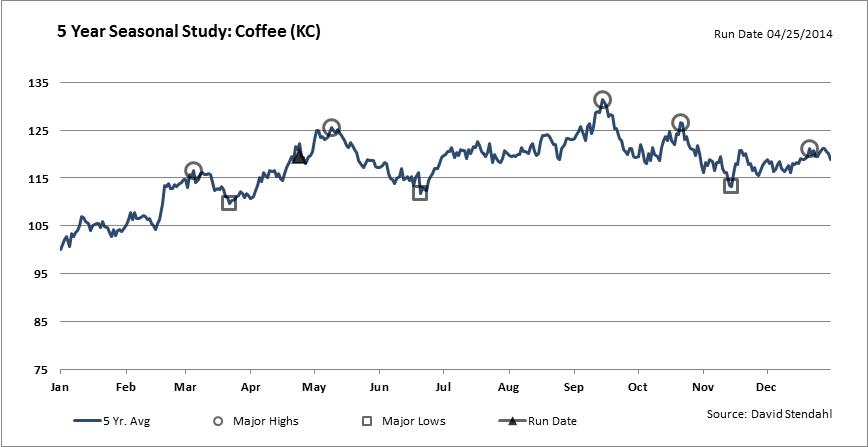

If we look at the 5-year seasonal trend for coffee we can see that historically a peak has been put in at the start of May. The same type of pattern also occurs on the 10-year and 15-year look back periods as well.

Disclaimer: The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.