Price breakouts are market conditions that occur after price action either rises above resistance or drops below support. Savvy traders that are aware of these conditions can quickly adapt their trading plan and be prepared to take advantage of the next market move.

As the EURUSD moves towards record low levels of volatility, traders are gearing up for the next big breakout for the pair. Today we will discuss the current developments of the EURUSD and how to place entries for the EURUSDs next big breakout.

The Trend

The EURUSD continues to be in the spotlight as the world’s most actively traded currency pair. This is for good reason, as the Euro continues to be one of the markets strongest currencies while trading near multi-year highs against the US Dollar. The chart above clearly depicts this strength as we see the Euro advancing as much as 1952 pips against the buck over a two-year period.

However, recent developments have shown weakness in the Euro. After printing a two-year high under the psychological 1.4000 mark, the EURUSD the pair has dropped as much as 262 pips. Technical traders bullish on the pair contend that the 200 MVA (simple moving average) is currently acting as support. Other traders contest that the EURUSD market is diverging and a reversal may be in place. So with so much uncertainty, how can active traders approach the EURUSD?

Why Trade A Breakout

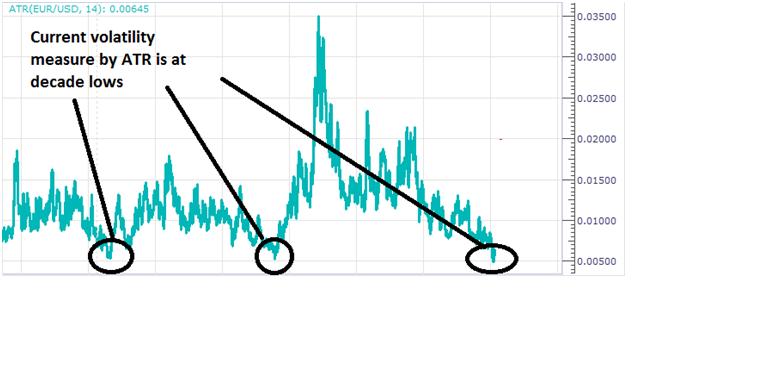

The answer to trading the EURUSD is trading a breakout! One sign that shows the EURUSD setting up for a breakout is volatility. Above we can see ATR (Average True Range) attached to the EURUSD daily chart. This indicator is seen reading at a 10 year low, which means price movements have slowed significantly! This makes it a prime candidate for a breakout when volatility returns to the market.

Another reason to trade breakouts is again market uncertainty. With traders and analysts on both sides of the fence arguing about direction, it can be confusing to know whether to look for a breakout to a new high or a new low. This can be settled through the use of an entry order. If an entry is placed, but the market moves in the opposing direction, the order can simply be deleted at no expense to the trader. Let’s take a look at how to trade with entry orders for the EURUSDs next breakout.

Trading The Break

To identify a breakout, traders should look for price to pass through a key level of support or resistance. When it comes to the EURUSD, traders will wait to see if price breaks through current resistance, which can be referenced by the current two year high at 1.3993. A break of this value would indicate a continuation of the trend as the EURUSD pushes towards higher highs. An alternative would be trading a break under the 200 MVA at 1.3625 which would signal a reversal.

Through the use of an OCO (One Cancels the Other) order, traders can place entries on either side of the market. This way if price breaks higher, the order to sell will simply be canceled. Conversely if price breakout to a new low, traders can be prepared to sell the market with buy orders then being deleted. Trading in this manner can be a huge benefit to traders that can’t monitor the market 24 hours a day. Even if you’re away from the trading screen and regardless of the direction the market decides to break, your trade will be pending and executed at the prevailing market price.

Managing Risk

The last step of trading a breakout is to manage risk. Even if price makes a new high or low, a stop order should be used in the event of a false breakout. One way to set your risk is to designate a stop order between your two entries. This way, regardless of the entry that is triggered, you will have an equal amount of risk designated with each order.

Once you have completed this final step you will be ready for the next breakout in the Euro! At this point, you can wait on the market and regardless of where the EURO moves, you will be prepared with your market entries.