In our last commentary we discuss how the rapid ascent in Utilities and the sudden weakness in our proprietary rating value caused concern to reduce exposure to Utilities. Remember, being investor to hide out in a safety trade is not prudent investing.

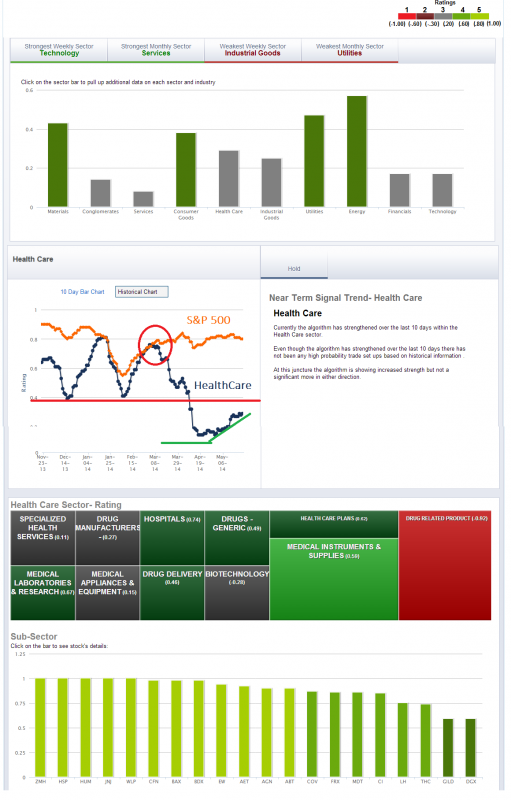

Today we wanted to look at a sector that has been punished in 2014, Healthcare. Our proprietary rating value is currently a hold on the sector. However, it is the only sector in the recent week that is gaining strength. For those who are not familiar with our rating value, it is a 10 factor model to grade the strength of each security independently and does not use relative strength.

If you defer to the graph comparing the HealthCare Sector you would have been selling this sector mid March as it significantly breached the S&P 500’s rating value. Since the sector never held the .40 level we backed away from the sector. Not until recently has the sector bottomed and gained strength as seen from the historical rating value graph.

As the sector rebounds, a rotation has occurred within the Sector and the Strongest Industry within the group is Hospitals, Medical Supplies and Medical Labs. All lower beta lower valuation stocks. The last bar graph on the bottom will show you the strongest stock from left to right. With ZMH, HSP, HUM, JNJ and WLP being the strongest names within the sector.

= = =

For your 30 day free trial visit www.chartlabpro.com