Shares of the mass media company, CBS Corp. (CBS), are down 7.25% year to date. The stock trades at a P/E ratio of 16.96x (2014 estimates), PEG ratio of 1.11x (2014 estimates), 1% revenue growth, and has a dividend yield of 0.81%. On February 13, Bank of America maintained a buy rating with a $80 price target. CBS own roughly 83% of CBS Outdoor Americas (CBSO), but plans to divest the investment later this year as CBSO plans to convert into a real estate investment trust (REIT).

Unusual Options Activity

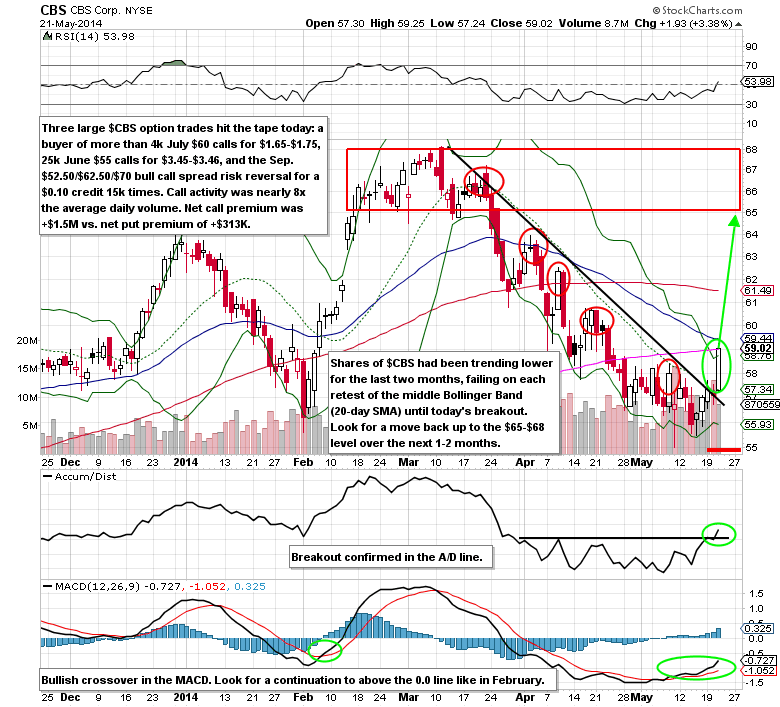

On Wednesday, May 21, several large bullish option trades hit the tape in CBS. These trades include a purchase of more than 4,000 July $60 calls for $1.65-$1.75, 25,000 June $55 calls for $3.45-43.46 (stock replacement), and a Sep. $52.50/$62.50/$70 bull call spread risk reversal that was put on a total of 15,000 times for a $0.10 credit. The call to put ratio was 3:1. Call activity was 7 times the average daily volume. Net call premium was +$1.5M vs. net put premium of +$313K. There has also been large call and call spread buying in the Jan. 2015 options expiration since the Q1 earnings report earlier this month.

Technical Analysis

Shares of CBS had been trending lower since March, failing on retests of the middle Bollinger Bands® until Wednesday’s upside breakout. The reward/risk ratio on the long side is better than 2:1 when using a stop loss under the current support level of $55. Upside potential is to the March highs over the next two months ($65-$68).

CBS Options Trade Idea

Buy the July $60/$65 call spread for a $1.50 debit or better

(Buy the July $60 call and sell the July $65 call, all in one trade)

Stop loss- None

1st upside target- $2.50

2nd upside target- $4.50

Disclosure: I’m long the July $60/$65 call spreads for a $1.25 debit and the stock for an average price of $59.16 (bought on 4/17 for $59.74 and on 5/21 for $58.58).