Valuing a publicly traded company is tough. Valuing an IPO, given its youth, somewhat unproven business model, lack of earnings and lack of evidence it can shift gears in a constantly changing world is virtually impossible to do with any degree of certainly. So how does Wall St. value an IPO, and how are expectations for the first several months of life determined? Often, their methods aren’t any more complex than what average high school kid could execute. They simply look at their peers and assume the newly public company will do about the same. On Friday, May 23, Parsley Energy (PE) went public. Let see how PE’s three closest competitors did during their early months as public companies. Unless something drastic happens in the world, PE will likely do the same.

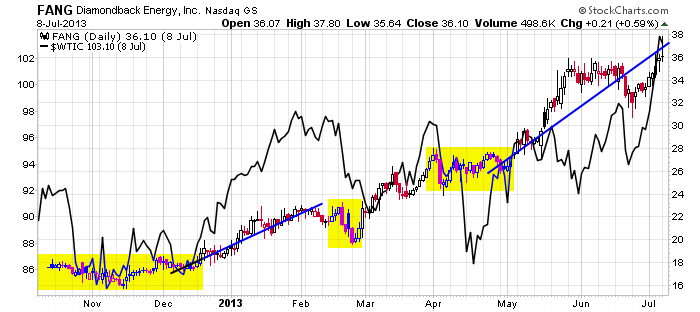

Diamondback Energy (FANG). The company went public in October of 2012 and had unfortunate timing. Oil dropped from $92 to the mid $80’s, and FANG bit its time by trading quietly in a range between $16 and $18. Then, when oil rallied from $86 to $97, FANG rallied from $18 to $22. A dip by oil caused FANG to drop to $20, but then oil rallied back up to $97, and FANG rallied up to $28. Continuing further in time, each time oil pulled back, FANG rested, and each time oil moved up, FANG rallied hard. The stock now sits in the low $70’s – a better than 300% gain in nineteen months. The chart below shows FANG during its first nine months as a publicly traded company, superimposed with crude oil.  Athlon Energy (ATHL). The company went public in August of 2013 and popped 30% on its first day of trading. An elevated oil level helped the stock rally from $26 to $34. Then oil dropped from $109 to $93, and after recovering some of its loss, dropped to $92. During this time ATHL traded in a range between $28 and $34. Oil then rallied back over $100, and ATHL rallied up to $38. Like FANG, each time oil pulled back, ATHL experienced a shallow correction and rested. When oil rallied, the stock surged. Today the stock sits at $42.49 – a double off its IPO price and 63% above its opening print.

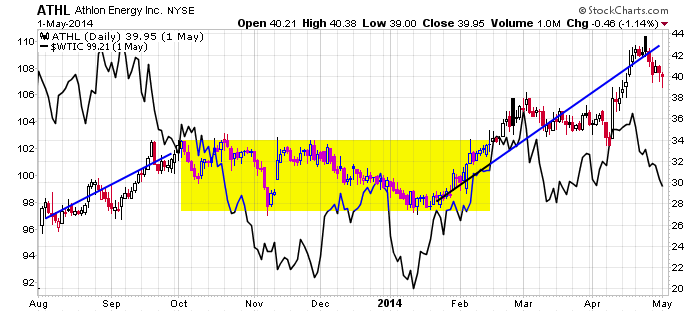

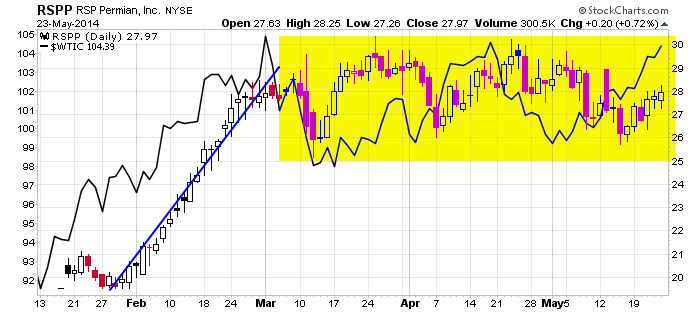

Athlon Energy (ATHL). The company went public in August of 2013 and popped 30% on its first day of trading. An elevated oil level helped the stock rally from $26 to $34. Then oil dropped from $109 to $93, and after recovering some of its loss, dropped to $92. During this time ATHL traded in a range between $28 and $34. Oil then rallied back over $100, and ATHL rallied up to $38. Like FANG, each time oil pulled back, ATHL experienced a shallow correction and rested. When oil rallied, the stock surged. Today the stock sits at $42.49 – a double off its IPO price and 63% above its opening print.  RSP Permian (RSPP). The company went public in January of 2014 and was fortunate to coincide its early days with a big oil rally. As oil climbed from $92 to $104, RSPP rallied from $20 to $29. Oil has traded in a range since, and RSPP has moved between $25 and $30. The stock now sits at $27.97 – a 43% gain in less than five months.

RSP Permian (RSPP). The company went public in January of 2014 and was fortunate to coincide its early days with a big oil rally. As oil climbed from $92 to $104, RSPP rallied from $20 to $29. Oil has traded in a range since, and RSPP has moved between $25 and $30. The stock now sits at $27.97 – a 43% gain in less than five months.  Parsley Energy is the new kid on the block – the latest IPO from the Permian Basin region of West Texas. The stock priced its IPO at $18.5 – above it’s previously-established $15-$18 range. It then opened at $22.30 and closed its first day of trading at $22.20 – a 20% pop. If it acts like its peers, we can expect two things going forward. 1) It will be very sensitive to crude oil’s movement. Being a small company, 10-20% dips while crude corrects would be par for the course. 2) If oil doesn’t completely tank, PE should be much higher 6-9 months from now. Yes, this analysis is simplistic, but it’s now worse than crunching a bunch of numbers.

Parsley Energy is the new kid on the block – the latest IPO from the Permian Basin region of West Texas. The stock priced its IPO at $18.5 – above it’s previously-established $15-$18 range. It then opened at $22.30 and closed its first day of trading at $22.20 – a 20% pop. If it acts like its peers, we can expect two things going forward. 1) It will be very sensitive to crude oil’s movement. Being a small company, 10-20% dips while crude corrects would be par for the course. 2) If oil doesn’t completely tank, PE should be much higher 6-9 months from now. Yes, this analysis is simplistic, but it’s now worse than crunching a bunch of numbers.